Can steel revive Europe’s industrial policy?

The situation of the European steel industry was on the agenda of the European Council’s Competitiveness session held on Monday, 29 February 2016. One of the Council’s conclusions was to issue a demand to speed up the anti-dumping investigations by two months. This demand follows a letter sent on 5 February to the European Commission by ministers from seven European countries, including France, Germany, Italy and the United Kingdom, urging it to take measures to protect the steel sector vis-à-vis what was deemed unfair competition from China and Russia.

The steel industry, which successively pushed forward Europe’s industrial development and then European cohesion through the European Coal and Steel Community (ECSC), subsequently became a theatre for the violent winds of globalization and a symbol of Europe’s industrial decline – will it now be the sector that leads a revival of Europe’s industrial policy?

In retrospect, a question arises as to whether the difficulties facing the European steel industry, which is subject both to the fussy oversight of the European Competition Commission and to low-cost Chinese imports, are partly a symptom of failings in Europe’s industrial policy, which is wedged between a very active competition policy and a timid trade policy?

The history of Europe’s steel industry does in fact fall closely in line with the history of Europe’s industrial policy: from a central and highly sectoral industry at the time of the ECSC, with a great deal of state aid going to the sector under various exemptions, it then became primarily horizontal and subject to competition policy. The sector only found its way by means of trade policy in response to increased competition from emerging countries. No steps have been taken in the steel industry towards European alliances or regroupings since the 1980s, and there have been no Europe-wide plans to rationalize production capacity so as to hold down the decline in jobs in the industry. This decline went hand in glove with the development of the continent’s specialization in high-tech steel products. But today even those jobs are under threat. Could a different industrial policy save them?

The state of the industry in Europe

Steel now accounts for 360,000 jobs in the European Union. The European sector has lost nearly a quarter of its workforce since 2009, with job losses accelerating: 3,000 jobs lost in the last 6 months.

In terms of production, the steel industry generates a turnover of 180 billion euros, with an output of 170 million tons from 500 production sites in 23 Member States. If countries are ranked individually in terms of international steel producers, Germany comes in 7th place, Italy 11th and France 15th. The sector is dependent on the import of iron ore, alumina and coal. Fortunately, the decline in steel prices has gone hand in hand with lower prices for these commodities. The industry is highly capital-intensive, requiring major investments. At the same time, the transport of steel coils and flat products is inexpensive, making it easier to import them.

The 2008 economic crisis cascaded through the sector, as steel products constitute intermediate consumption for many other industrial sectors as well as for construction. Steelmakers in Europe also face stricter environmental constraints than elsewhere. The steel industry is a major source of CO2 emissions, and is very sensitive to carbon prices and to regulatory changes. It is also a key player in the EU’s emissions trading system (ETS) for greenhouse gas quotas, and while the crisis has enabled the industry to make profits from the sale of surplus emissions rights, steelmakers who are currently experiencing problems vis-à-vis their non-European competitors will be very sensitive to the forthcoming reform of the system for the 2020-2030 period.

Some companies are now in real trouble, such as Arcelor Mittal, which announced a record loss for 2015 (nearly 8 billion euros), partly due to the need to depreciate its mines and steel stocks. The company, which is heavily in debt because of its many acquisitions in Europe, plans to close some plants. Tata Steel, for its part, has closed sites in Britain. In Japan, Nippon Steel, which just acquired an interest in the capital of the French firm Vallourec and is preparing to buy the Japanese Nisshin Steel, is doing better.

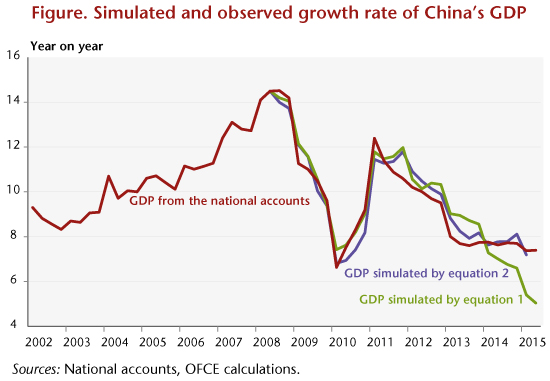

The difficulties facing a sector that built up excess capacity during the crisis have been aggravated by the economic downturn in China. Thus, 2015 was the first year to experience a decline (-3%) in global production (1,622 million tons), after 5 years of growth. Global production did not adjust immediately to falling demand, with prices initially acting as the adjustment variable. The decline in production was the signal for the closures of steel factories and mining operations. This has marked the end of a cycle of rising Chinese production that strongly destabilized the market.

The Chinese tornado

Chinese production doubled in volume between 2000 and 2014, and on its own now accounts for more than twice the combined output of the next four major producing countries, Japan, India, Russia and the United States. This performance is the result of several factors: massive government support; dynamic growth in construction, in infrastructure investment, and in the Chinese market’s production of cars and machinery; and favourable access to iron ore. China produces nearly 50% of the world’s steel, i.e. approximately 800 million tons of steel. The second-largest producer is Japan, with 100 million tons. India and the United States are contending for third place, at around 5% of global production. If we count the Europe-28 as a single entity, then it would take second place with 10% (Source: World Steel Association). But the slowdown in the Chinese economy and the strong inertia characterizing production capacity in the steel industry have created substantial excess capacity, which the authorities are now trying to reduce. Domestically, China needs only about half of its output, so it exports the other half.

The 400 million tons China exports represent twice Europe’s output. The price of the Chinese offer is therefore likely to greatly upset the balances in other countries. Any excess capacity is directed onto foreign markets to be gotten rid of at low prices, as Chinese exporters are not going to fail to sell off their steel products. Hence China’s exports to Europe rose from 45 million tons in 2014 to 97 million tons in 2015, which exceeds the 43 million tons produced by Germany.

China is also likely to experience a significant decline in its workforce, and some production sites, drowning in massive debt, have already closed. Chinese steelmakers are losing money, and small units are going bankrupt. Large units, however, are often state property, and are weathering the storm (at the cost of heavy indebtedness) and becoming aggressive predators, in terms not only of price but also of acquisition capabilities. The weak position of Europe’s firms is also leaving them vulnerable to foreign takeovers. China Hebei Iron and Steel Group is, for instance, about to acquire a Serbian steelmaker, which would be yet another means of entering Europe.

The policy response

The public authorities have long been heavily involved in the steel sector. It was a strategic sector for post-war economic development, and was the source of European economic construction at a time when the “small steps” policy of Robert Schuman led to putting the coal and steel production of France and Germany under a common authority, later joined by other countries. For a long time the sector then benefited from various public aid measures and subsidies that kept up excess capacity relative to demand, now estimated at 10-15% of output. The sector then was gradually freed from public tutelage, and in the mid-1990s was excluded from the list of sectors in difficulty that were eligible for aid for restructurings and bailouts. Nevertheless, state support never disappeared completely, but today, the European Commission, through the Competition Commission, is relatively strict about applying the market investor principle to assess the legality of public support.

While tracking distortions in competition on the market, the European Commission recently opened an investigation into Italy’s support for the steelmaker Ilva (2 billion euros), and demanded that Belgium repay 211 million euros of aid paid to the steelmaker Duferco. In 2013, the Commission opened an investigation into aid awarded by “Belgian Foreign Strategic Investments Holding” (FSIH), a body created in 2003 by the Walloon management and investment company Sogepa to invest in the steel industry. This aid, paid between 2006 and 2011 by the Walloon government [a Belgian regional government], was considered to constitute unfair competition on the European market. Indeed, for the Commission, private investors would not have voluntarily made such investments.

These subsidies by the Walloon government therefore constituted aid that put competitors at a disadvantage. The Commission recognized that there is very strong foreign competition, but it considered that the best way to cope with this is to have strong, independent European players. It noted that despite the government aid, the Duferco group wound down all its activities in Belgium, meaning that the aid merely postponed the departure of a company that was not viable. The Commission is currently supporting the retraining of workers in the Walloon region through the European Globalisation Adjustment Fund. The point is to combat the recourse to public funding in Europe, which would ultimately be detrimental to the sector.

At the same time, so-called “anti-dumping” trade retaliation measures were implemented by the European Commission. In May 2014, following a complaint from Eurofer (the European steel association), the Commission imposed temporary anti-dumping duties of up to 25.2% on imports of certain steel products from the People’s Republic of China and duties of up to 12% on imports from Taiwan. The EC investigation ultimately concluded that China and Taiwan were selling at dumping prices. More recently, Cecilia Malmström, the head of trade policy at the European Commission, wrote to her Chinese counterparts warning them that she was launching three anti-dumping investigations against Chinese exporters (February 2015) in the field of seamless pipes, heavy plates and hot-rolled steels. Provisional anti-dumping duties (of between 13% and 26%) were also set on 12 February 2016 (complaints in 2015) with respect to China and Russia.

Some thirty anti-dumping measures protect the European steel industry, but the Member States where steel has been hit particularly hard by Chinese competition are calling for stronger measures. Politicians are railing against China’s loss-making exports and demanding that Europe take steps. They envy the US, which has acted more quickly and not skimped on the level of the duties it’s enacted, i.e. up to 236%. But the nature of these measures depends on the economic status accorded to China. Anti-dumping measures are not defined in the same way. As long as China is not a market economy, it is assumed that it provides strong support for its economic sectors, and that its prices are thus not market prices. Italy is struggling in Europe to prevent China from being granted this status, while the United Kingdom is supporting China at the WTO (even though the industry is also in trouble in Britain). The Commission has postponed its decision until summer.

What policy for tomorrow?

Should we allow the production of steel to disappear in Europe? It still represents more than 300,000 jobs there, though this is of course out of more than 35 million jobs in manufacturing in 2014. The sector is symbolic of heavy industry, and a supplier of the transportation and defence industries as well as construction – its disappearance would definitively turn a new page in European industry.

Do we need to recognize that, according to the theory of comparative advantage, it is better to buy cheaper Chinese steel and use the revenue freed up for other, more profitable uses? For example, shouldn’t it be used to upskill employees? In theory yes, but the revenue freed up goes to the purchasers of steel, so it is they who should supply the European conversion fund. What about taxing the consumption of the now cheaper steel? The flaw in the reasoning shows up when you realize that what is true with respect to macroeconomic balances is difficult to reconcile with microeconomic imbalances: those who are losing their jobs today are not the consumers who are benefitting. Ultimately, the microeconomic articulations can unsettle the macroeconomic balances.

The loss of know-how is indeed the main challenge, as it is here that resources are really wasted. In so far as skills are a competitive factor, difficulties related to a lack of demand should be considered transitional problems that need to be managed as well as possible. Neither contributions of foreign capital nor government support should be excluded. What justifies these investments are the returns expected from the use of human capital. To deal with these challenges, alliances on market segments that are not in trouble might be possible, even if they confer excessive market power, so long as they allow margins that make it possible to maintain the business during cyclical difficulties.

This is why competition policy has to be opened up to considerations of industrial policy (which is concerned about expertise) and trade policy (which appreciates the cyclical and / or unfair character of competition).

European actors need to be brought around a table – they are already grouped in Eurofer – and together with the European Commission develop a European plan for managing excess capacity and forging alliances. The Competition Directorate of the European Commission needs to relax its intellectual rigidity and adapt its reading of competition to the nature of contemporary globalization. Although it is based on an indisputable logic in the name of the single market, the approach of the Competition Directorate is sometimes no longer suited to the way that competition is unfolding on the global value chain today, which has no precedent on the 20th century European market. Who would believe that the market power resulting from a European merger would not be challenged very quickly by foreign forces if the new enterprise began to take advantage of its market power? The limits on market power are much stronger in the 21st century, with low inflation and depressed commodity prices an illustration of this. The risk that multinationals might abuse their power is posed less in terms of excessive prices than excesses in the capture of customers and in tax avoidance. This last point seems to have been understood clearly by the European Commission. In addition to this, there is the added competition from new applications driven by the digital industry, which manufacturers cannot escape. In other words, competition is no longer what it used to be: companies’ excessive power is no longer expressed much in prices or restrictions on quantities.

Competition policy, industrial policy and trade policy need to be developed in coordination, with a strengthened Competition Directorate that includes an element of industrial policy and trade policy. While strict controls on competition were a clear priority during the period of forging the single market when competition was essentially focused between the developed countries, today it is urgent to review the linkages between these three policy fields in order to consolidate the future of industry in Europe.