By Raul Sampognaro

If the budget submitted by France is out of step with the rules on fiscal governance in the euro area (see the recent posts on this subject by Henri Sterdyniak and Xavier Timbeau), Italy is also in the hot seat. The situations of France and Italy are, however, not directly comparable: the case of Italy could be far more restrictive than that of France, once again reflecting the perverse effects of Europe’s new governance. While, unlike France, Italy is no longer subject to an Excessive Deficit Procedure (EDP), with its budget deficit at the 3% threshold since 2012, it is still covered by the Stability and Growth Pact’s preventive arm and thus enhanced surveillance with respect to the debt criterion. The country’s debt of 127% of GDP is well above the 60% level set by EU rules and, according to its medium-term budgetary objective (MTO), Italy must come close to balancing government spending.

While the French budget deficit for 2015 will be the highest in the entire euro area (excluding countries subject to a programme [1]), since the latest announcements on October 28, Italy has a deficit of 2.6%, which should not trigger a new EDP. However, the Pact’s preventive arm puts constraints on changes in the country’s structural balance:

– (i) in the name of convergence towards its MTO, Italy must make a structural adjustment of 0.5 percentage point per year for 3 years (i.e. cut its structural deficit by 0.5 point per year),

– (ii) if the structural deficit defined in the MTO is not sufficient to reach a debt level of 60% within 20 years, the country must make an extra effort under the debt criterion. According to the latest forecast by the Commission, Italy must provide an average annual structural effort of 0.7 point in 2014 and 2015.

Yet the government is counting on a deterioration in the structural balance of 0.3 point in 2014, followed by an improvement of 0.4 point in 2015.

Thus, while according to the Commission the treaties require Italy to make a cumulative effort of 1.4 point in 2014 and 2015 (for its part the Italian Government considers that this effort should instead be 0.9 point), Italy is announcing an improvement in its structural balance of 0.1 point during the period, a difference of 1.3 points from that demanded by the Commission. From this perspective, Italy is further from European requirements than France, and will have to justify its lack of a structural adjustment. In addition, Italy is not expected to reach its MTO in 2015, even though at the end of the European Semester in July 2014 the Council had recommended it stick to the 2015 target.

Italy is the first country to be constrained by the debt criterion and is serving as a laboratory for the application of the rules by showing some of their adverse effects. Indeed, the adjustment required under the debt criterion is changing in line with several parameters, some of which were not really anticipated by the legislator. For example, the amount of the adjustment depends on a forecast of the ratio of nominal debt / nominal GDP at the end of the transition phase. However, the fall in prices currently underway in Italy is lowering the nominal GDP forecast for the next three years, without any change in fiscal policy. Thus, the debt criterion is tightening mechanically without any government action, endlessly increasing the need for structural adjustment as the new adjustments induce more deflation. In addition, the procedures used to find deviations from the debt criterion are slower because the controls are carried out essentially ex post, based on the accumulated deviations observed over two years. However, the magnitude of the deviation announced by the Italian government could spark procedures based on ex ante control. Recall, however, that unlike France, Italy is not currently in a procedure. This would have to be opened before any sanctions could be envisaged against Italy. This preliminary and necessary step gives the Italian government time to take suitable measures or to justify its deviation from the MTO.

Furthermore, the EDP’s preventive arm provides more opportunities for deviation than the corrective arm. In addition to the clause on exceptional economic circumstances, Italy can argue major structural reforms that will improve the future sustainability of the debt. This argument, which is also raised by the French government, is not set out in the EDP text (the Commission could accept some flexibility). Here, however, the Renzi government is drawing on its reputation as more of a reformer than the French government.

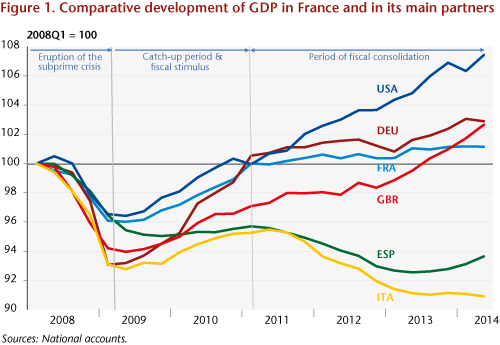

Both governments have requested the application of the exceptional economic circumstances clause in order to break their commitments. The Commission could be more sensitive to the Italian request because its economic situation has deteriorated: Italy has seen 3 years of falling GDP, which is continuing in the first half of 2014. The country’s GDP is 9 points below its pre-crisis peak, while in France it is one point higher. The latest survey indicators, for example on industrial production, do not augur well for recovery in the short term. Finally, Italy is suffering deflation.

In summary, while the Italian gap seems larger than that of France, it could benefit from greater indulgence. The procedures applied to each country differ and give Italy more time before any sanctions can be applied. The country’s willingness to reform could win it higher marks than France from the Commission. Finally, the most important point in the discussion is that Italy’s economic situation is much more serious, with an uninterrupted recession since the summer of 2011 and with prices falling.

But in both cases the reinforced pact, whether it is corrective or preventive, implies endless structural adjustment. Italy demonstrates that getting out of the excessive deficit procedure will demand continuing efforts to meet the debt criterion. If France leaves the EDP in 2017, its debt will be, according to government forecasts, around 100% of GDP. It must then continue with adjustments of more than 0.5%. Confirmation of deflation will make the Pact’s rules even more recessive and absurd. Ultimately, the fiscal pact meant to preserve the euro by chasing free-riders or stowaways could lead to blowing it apart through an endless recession.

[1] Greece, Ireland and Portugal have received European aid and thus have been subject to joint monitoring by the ECB, the IMF and the European Union. Ireland and Portugal are now out of their bailout programme.