Should the ECB be concerned about the recent rise in inflation?

by Christophe Blot, Caroline Bozou and Jérôme Creel

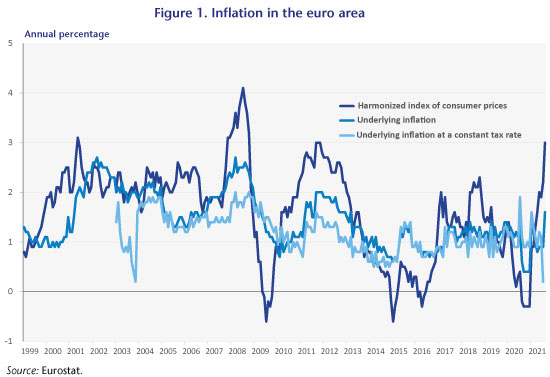

In August 2021, inflation in the euro area reached

3% year-on-year. This level, which has not been seen since November 2011, exceeds

the European Central Bank’s target of 2%. This recent momentum is being driven partly

by oil prices, but there has been a simultaneous rebound in underlying inflation,

which excludes the energy and food price indices from the calculation.

Inflation in the United States is also returning to levels not seen for several

years, fuelling the debate on a potential return of inflationary risks. Given

the central banks’ mandate to maintain price stability, it is legitimate for them

to examine the sources of renewed inflation. In a recent paper in preparation

for the Monetary Dialogue between the European Parliament

and the ECB,

we discuss the temporary rather than permanent nature of this episode of

inflation.

The recent development of inflation cannot be

dissociated from the overall economic situation, which today is still strongly affected

by the health crisis. After a sharp fall in activity – GDP contracted by 6.5%

in 2020 – the macroeconomic performance of the euro area remains erratic. The

crisis has been unprecedented both in terms of its scale and in terms of its

sectoral characteristics and the nature of the shocks that have hit the euro

area economies. The Covid-19 crisis has in reality been characterised by a simultaneous

negative shock to both supply and demand (see Dauvin and Sampognaro, 2021).

The factors driving current inflation appear to be

temporary in nature. Indeed, a review of recent data suggests that the rise in

inflation is mainly due to energy prices, to changes in Value-Added Tax rates

and to the recovery from the most dramatic one-year recession since World War

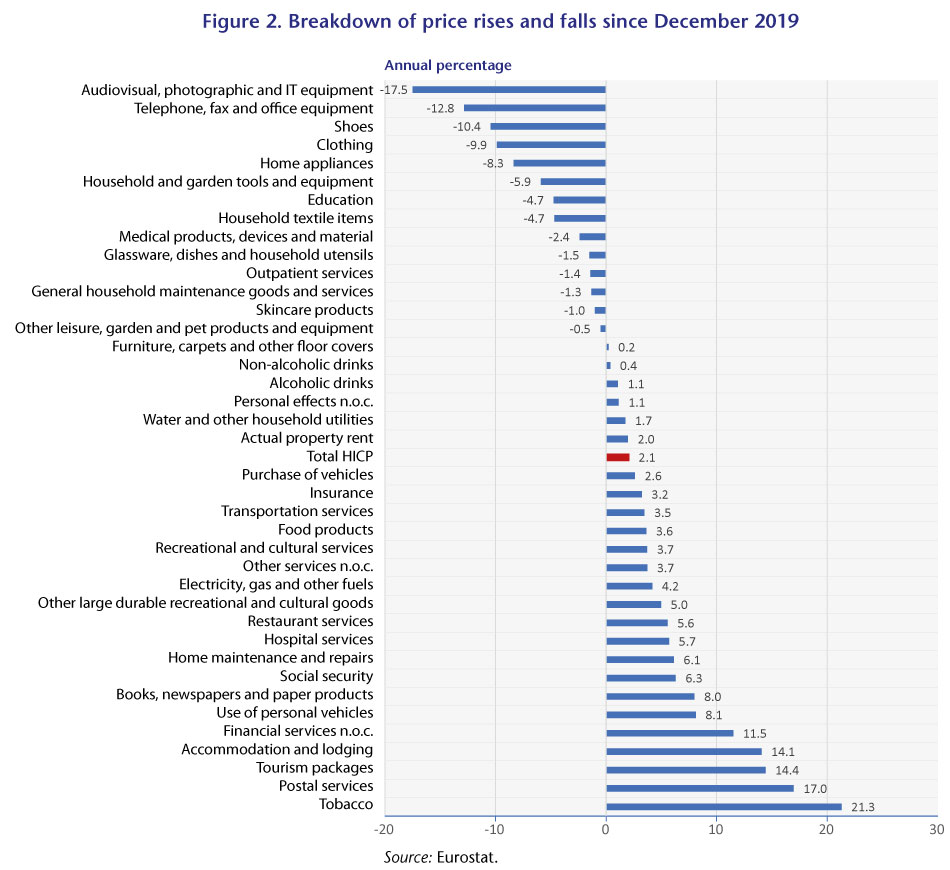

II (Figure 1). However, at a disaggregated level, it appears that for most

goods, prices are often below the December 2019 level, while prices for some

services are higher (Figure 2).

Nevertheless, there are many factors that could

influence inflation over the medium term, and they leave some uncertainty about

future pressure. The demand shock from the European fiscal stimulus and from labour

market pressures is likely to be small. The inflationary cost of a fall in euro

area unemployment is now very low – there is talk of a flattening of the

Phillips curve, see Bobeica, Hartwig, and Nickel, 2021) – and job

vacancies, though high, are below the levels of 2018 when there were no fears

of a return of inflation. However, agents’ dissaving behaviour is generating

inflationary pressures that could herald a more uncertain path. A surge in

demand could fuel future price increases, especially if the difficulties in supply

adjustment observed recently in certain sectors were to persist. As for supply

difficulties and the rising cost of maritime transport, the latter’s strong

correlation with oil prices suggests this will fall over the next two years

(see the US

Energy Information Administration bulletin).

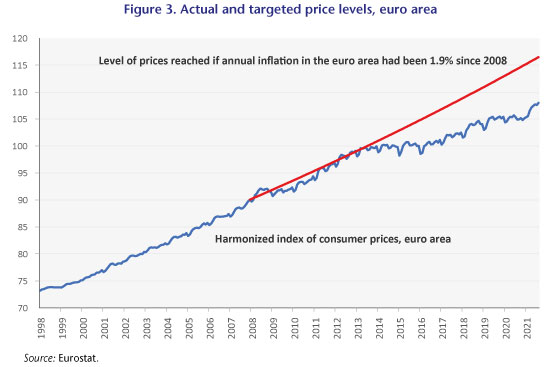

However, if we take a longer view, we can see that the upturn in inflation in no way makes up for the many years during which inflation fell below the 2% target (Figure 3). Thus, as long as the surge observed in recent months remains contained, this return of inflation could be seen as good news for the ECB, enabling it to finally reach its target and even possibly make up for past under-adjustments.