Central bank asset purchases: Inflation targeting or spread targeting?

by Christophe Blot, Jérôme Creel, and Paul Hubert

Five years after the

ECB launched its asset purchase programme (APP), the Covid-19 crisis has put

the ECB again at the center of euro area attention, with a new extension of APP

and with the creation of the Pandemic Emergency Purchase Programme (PEPP). The simultaneity between

APP’s extension and PEPP – they were decided within a two-week interval – could

be interpreted as arising from the pursuit of the same objective. This

interpretation may be misleading though and may bias the respective appraisal of

these policies.

The APP arrived at a

moment when the euro area was facing strong deflationary risks whereas the PEPP

was implemented when the inflation outlook was unclear (because the Covid-19

crisis is a mix of a supply, demand and uncertainty shocks) but fragmentation

risks were on the upside. Sovereign risks and increasing spreads could impair

the transmission of monetary policy across euro area countries. The declared

will by ECB officials to tackle the fragmentation of the euro area and the (temporary)

removal of the self-imposed limits on asset purchases suggest that the ECB sets

a sort of a “spread targeting” objective to the PEPP. We develop this argument

in a recent Monetary Dialogue Paper for the ECON committee of the

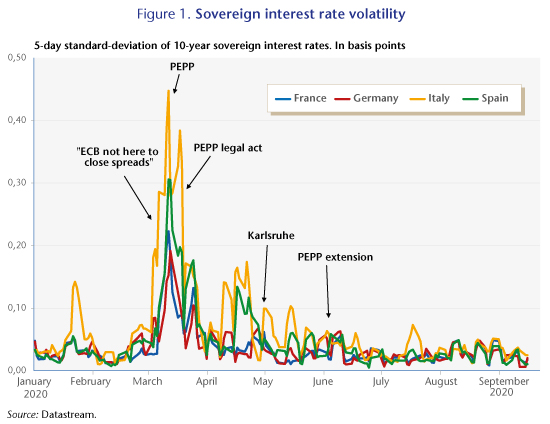

European Parliament. From the point of view of this “spread targeting”

objective, the PEPP is successful with both the level and volatility of

sovereign spreads at low levels (figure 1).

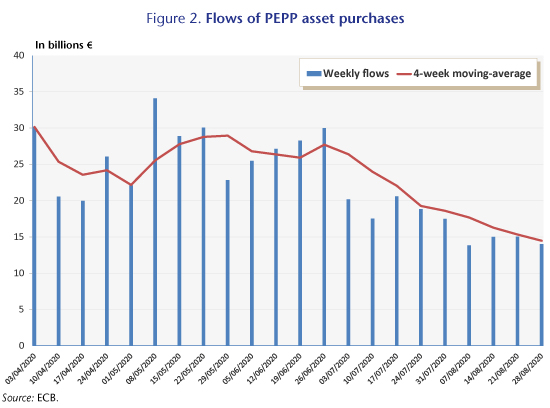

This outcome was

obtained without a full utilisation of the potential resources of the PEPP. The

weekly flow of purchases is even decreasing since July (figure 2). This

suggests that the signaling effect of the PEPP has been strong and credible in

taming sovereign stress. It also suggests that the ECB is not short of

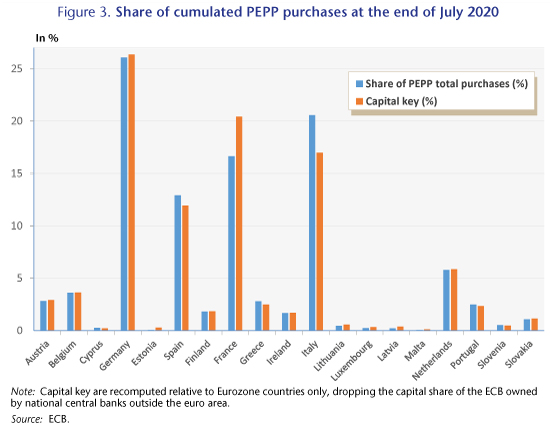

ammunitions if the crisis persists or intensifies. The outcome of the PEPP was

also achieved without deviating much from the ECB capital key (figure 3),

except for France (for which the ECB capital share exceeds bond purchases) and

Italy (for which bond purchases exceed the share at the ECB capital exceeds).

The ruling of the

German Federal Constitutional Court last May has revived discussions on the

adequacy of asset purchases by the ECB.[1]

Discussions have

opposed those who think that the ECB has had “disproportionate” economic policy

effects (on public debts, personal savings and the keeping afloat of

economically unviable companies) and those who think that the distinction

between the “monetary policy objective” and “the economic policy effects

arising from the programme” is misleading. The reason is that this distinction

seems to imply that achieving the objective of the ECB – inflation at the 2%

target – can be achieved without interactions with other macroeconomic and

financial variables, which is nonsense. Moreover, this distinction gives too

much weight to the price stability objective during a real economic crisis at

the expense of all the secondary objectives that the Treaty on the Functioning

of the EU imposes to the ECB.

Finally, the success or

failure of a given policy must be assessed according to its objective(s). In

that respect, the PEPP, under the assumption that it aimed at reducing

sovereign spreads to avoid the fragmentation of the euro area, has been

effective. Although it may depart from the ECB mandate that does not explicitly

mention the reduction of sovereign spreads as a monetary policy objective, PEPP

has improved the transmission of monetary policy. In a situation where the

pandemic crisis requires a fiscal stimulus more than a fiscal consolidation and

where a rise in inflation or in real GDP is very unlikely, the accommodative

ECB monetary policy has been undeniably relevant to ensure public debt

sustainability in Europe and to remove the risk of a break-up of the euro area.

[1] It also revived discussions on the ability of the Bundesbank to

continue to be involved in unconventional monetary operations. At the end of

June 2020, the Bundestag pronounced itself in favour of the ECB and PEPP which,

in the short term, removes the threat of an early end to monetary easing. This

will however not prevent a further appeal by German plaintiffs against the ECB

and, in the longer term, a new judicial episode.