by Danielle Schweisguth

At a time when the IMF has publicly recognized that it underestimated the negative impact of fiscal adjustment on Europe’s economic growth, Spain is preparing to publish its public deficit figure for 2012. The initial estimate should be around 8% of GDP, but this could be revised upwards, as was the case in 2011 – while the target negotiated with the European Commission is 6.3%. With social distress at a peak, only a sustainable return to growth would allow Spain to solve its budget problems through higher tax revenue. But the austerity being imposed by Europe is delaying the return of economic growth. And the level of Spain’s fiscal multiplier, which by our estimates is between 1.3 and 1.8, is rendering the policy of fiscal restraint ineffective, since it is not significantly reducing the deficit and is keeping the country in recession.

At a time when the IMF has publicly recognized that it underestimated the negative impact of fiscal adjustment on Europe’s economic growth – the famous fiscal multiplier – Spain is preparing to publish its public deficit for 2012. The initial estimate should be around 8% of GDP, but this could be revised upwards as was the case in 2011. If we exclude the financial support for the banking sector, which is not taken into account in the excessive deficit procedure, the deficit then falls to 7% of GDP. This figure is still higher than the official target of 6.3% that was the subject of bitter negotiations with the European Commission. Recall that until September 2011, the initial target deficit for 2012 was 4.4% of GDP. It was only after the unpleasant surprise of the publication of the 8.5% deficit for 2011 (which was later revised to 9.4%) – which was well above the official 2011 target of 6% of GDP – that the newly elected government of Mariano Rajoy asked the European Commission for an initial relaxation of conditions. The target deficit was then set by Brussels at 5.3% of GDP for 2012. In July 2012, pressure on Spain’s sovereign rate – which approached 7% – then led the government to negotiate with the Commission to put off the 3% target to 2014 and to set a deficit target of 6.3% of GDP in 2012.

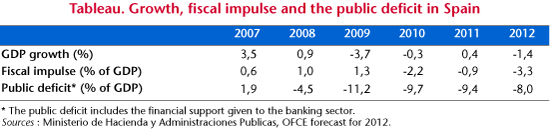

But the strategy of trying to reduce the deficit by 2.6 GDP points while in a cyclical downturn proved to be ineffective and even counter-productive. Furthermore, the result has not been worth the effort involved, even though the European authorities have praised it repeatedly. A succession of three consecutive years of austerity plans of historic proportions (2010, 2011 and 2012) has led to only a very small improvement in the budget balance (Table). The deficit was reduced by 3.2 percentage points in three years, while two years of crisis were enough to expand it by 13.3 points (from 2007 to 2009). The fiscal impulse was ‑2.2 percentage points of GDP in 2010, -0.9 point in 2011 and -3.3 points in 2012, or a total of 6.4 GDP points of fiscal effort (68 billion euros). Yet the crisis has precipitated the collapse of the real estate market and greatly weakened the banking system. Since then, the country has plunged into a deep recession: GDP has fallen by 5.7% since the first quarter of 2008, which puts it 12% below its potential level (assuming potential growth of 1.5% per year), with 26% of the workforce currently unemployed, in particular 56% of the young people.

The deterioration of Spain’s economic situation has hit tax revenue very hard. Between 2007 and 2011, the country’s tax revenues have fallen further than in any other country in the euro zone. Revenue declined from 38% of GDP in 2007 to 32.4% in 2011, despite a hike in VAT (2 points in 2010 and 3 points in 2012) and an increase in income tax rates and property taxes in 2011. The successive tax increases only slightly alleviated the depressive effect of the collapse of the tax base. VAT revenues recorded a sharp drop of 41% in nominal terms between 2007 and 2012, as did the tax on income and wealth (45%). In comparison, the decrease in tax revenue in the euro zone was much more modest: from 41.2% of GDP in 2007 to 40.8% in 2011. Finally, rising unemployment has undermined the accounts of the social security system, which will experience a deficit of 1 percentage point of GDP in 2012 for the first time in its history.

To compensate for the fall in tax revenue, the Spanish government had to take drastic measures to restrict spending to try to meet its commitments, including a 5% reduction in the salaries of civil servants and the elimination of their Christmas bonus; a hiring freeze in the public sector and increasing the work week from 35 to 37.5 hours (without extra pay); raising the retirement age from 65 to 67, along with a pension freeze (2010); a reduction of unemployment benefits for those who are unemployed more than seven months; and lowering severance pay from 45 days per year worked to 33 days (20 if the company is in the red). Even though household income has stagnated or declined, Spanish families have experienced a significant increase in the cost of living: a 5-point increase in VAT, higher electricity rates (28% in two years), higher taxes on tobacco and lower reimbursement rates for medicines (retirees pay 10% of the price and the employed 40% to 60%, depending on their income).

The social situation in Spain is very worrying. Poverty has increased (from 23% of the population in 2007 to 27% in 2011, according to Eurostat); households failing to pay their bills are being evicted from their homes; long-term unemployment has exploded (9% of the labour force); unemployed youth are a lost generation, and the best educated are emigrating. The VAT increase in September has forced households to tighten their budgets: spending on food declined in September and October 2012, respectively, by 2.3% and 1.8% yoy. Moreover, the Spanish health system is suffering from budget cuts (10% in 2012), which led to the closure of night-time emergency services in dozens of municipalities and to longer waiting lists for surgery (from 50,000 people in 2009 to 80,000 in 2012), with an average waiting time of nearly five months.

Social distress is thus at a peak. The movement of the indignados led millions of Spaniards to take to the streets in 2012, in protests that were often violently suppressed by riot police. The region of Catalonia, the richest in Spain but also the most indebted, is threatening to secede, to the consternation of the Spanish government. On 24 January, the Catalan government passed a motion on the region’s sovereignty, the first step in a process of self-determination that could lead to a referendum in 2014.

Only a lasting return to growth would enable Spain to solve its budget problems through higher tax revenue. But the tightening of financing conditions on Spain’s sovereign debt since the summer of 2012 has forced the government to strengthen its austerity policy, which is delaying the return to economic growth. Furthermore, the European Commission has agreed to provide financial assistance to Spain only if it renounces its sovereignty in budget matters, at least partially, which the government of Mariano Rajoy is still reluctant to accept. The initiative of the European Commission on the exclusion of capital expenditures from calculations of the public deficit for countries close to a balanced budget, the details of which will be published in the spring, is a step in the right direction (El Pais). But this rule would apply only to the seven countries where the fiscal deficit is below 3% of GDP (Germany, Luxembourg, Sweden, Finland, Estonia, Bulgaria and Malta), which leaves out the countries facing the most difficult economic situations. Greater awareness of the social dramas that underlie these poor economic performances should lead to greater respect for the fundamental rights of Europe’s citizens. Moreover, in the 2013 iAGS report the OFCE showed that a restrained austerity policy (budget restrictions limited to 0.5 percent of GDP each year) is more effective from the viewpoint of both growth and deficit reduction in countries like Spain where the fiscal multipliers are very high (between 1.3 and 1.8, according to our estimates).