Sweden and Covid-19: No lockdown doesn’t mean no recession

By Magali Dauvin and Raul Sampognaro, DAP OFCE

Since the Covid-19 pandemic’s

arrival on the old continent, a number of countries have taken strict measures

to limit outbreaks of contamination. Italy, Spain, France and the United

Kingdom belatedly stood out with especially strict measures, including lockdowns

of the population not working in key sectors. Sweden, in contrast, has

distinguished itself by the absence of any lockdown. While public events have

been banned, as in the other major European countries, there were no

administrative orders to close shops or to impose legal constraints on domestic

travel[1].

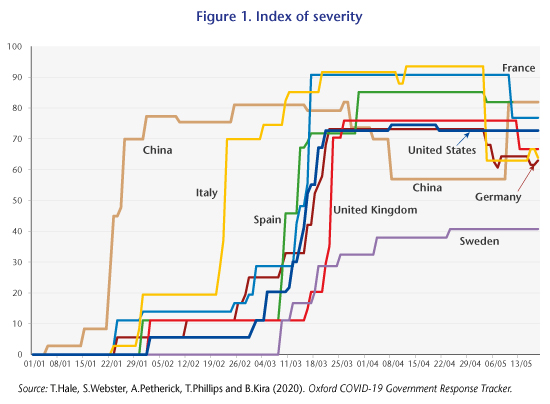

Given the

multiplicity of measures and their qualitative nature, it is difficult to break

down all the decisions taken, and in particular to express their intensity.

Researchers at the University of Oxford and the Blavatnik School of Government

have nevertheless built an indicator to measure the severity of government

responses[2]. This indicator clearly shows Sweden’s specific

situation with respect to the rest of Europe (Figure 1).

The mobility data supplied

by Apple Mobility provides a complementary picture of the severity of

containment measures across countries. At the time of the toughest lockdowns, automobile

mobility was down by 89% in Spain, 87% in Italy, 85% in France and 76% in the

United Kingdom. The decline was less severe in Germany and the United States

(about 60% in both countries). Sweden ultimately saw its traffic reduced by

“only” 23%. While these data should be taken with a grain of salt,

they also give a clear signal about the timing and scale of the lockdowns in

different countries, once again pointing to a Swedish exception.

During the first half

of May, the various European countries began to gradually ease the measures

taken to combat the spread of the Covid-19 epidemic.

Sweden’s

GDP resists in Q1

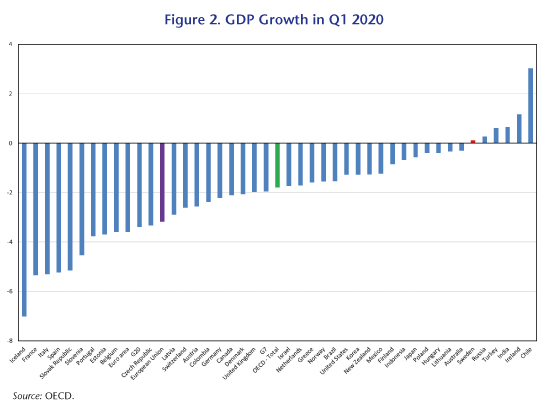

In our assessment of

the impact of lockdowns on the global economy, we highlighted the correlation between the fall in

GDP observed in the first quarter and the severity of the measures put in place

to combat Covid-19. In this context, Sweden (in red in Figure 2) fares

significantly better than the OECD member countries (green bar), and especially

the rest of the European Union (purple bar). Although this is a first estimate,

GDP has not only held up better than elsewhere, but has even stabilized (‑0.1%).

Only a few emerging economies, which were not affected by the pandemic at the

beginning of the year (Chile, India, Turkey and Russia), and Ireland, which

benefited from exceptional factors, performed better in the first quarter [3].

The relative

resilience of Sweden’s GDP in the first quarter seems to suggest that the

country might have found a different trade-off between epidemiological and

economic objectives compared to other countries[4]. However, this aggregate figure masks important

developments that need to be kept in mind. In the first quarter,

the stabilisation of Swedish GDP was due to the positive contribution made by foreign

trade (up 1.7 GDP points) to a rise in exports (up 3.4% in volume terms),

particularly in January, before any health measures were taken.

In the first quarter,

Swedish domestic demand pulled activity downwards (by ‑0.8 GDP points due to household

consumption and -0.2 GDP points due to investment), as in the rest of the EU. The

shock to domestic demand was of course more moderate than in the euro area,

where consumption contributed negatively to GDP by 2.5 points and investment by

0.9 points. Nevertheless, the physical distancing guidelines issued in Sweden must

have had a significant impact during the first quarter.

In a

troubled global context, Sweden will not be able to escape a recession

If we assume that the

avoidance of a lockdown and the relatively limited administrative closures (confined

to public events) did not give rise to any significant shock to domestic demand

– which seems optimistic in view of the first quarter data – Sweden will

nevertheless be hit hard by the shock to international trade[5].

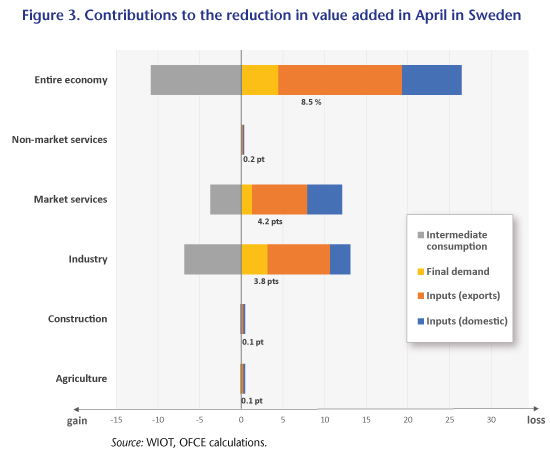

According

to our calculations, based on the entry-exit tables from the World Input-Output

Database (WIOD)[6] and our estimates related to the

lockdown shocks in Policy Brief 69, value added is expected to fall by

8.5 points in Sweden in April due to the containment measures taken in the rest

of the world. The shock will hit its industry especially hard, more or less in

line with what we estimate globally (-19% and 21%, respectively).

Unsurprisingly, the refining industry (-32%), the manufacture of

transport equipment (-30%) and capital goods (-20%), and the other

manufacturing industries sector (-20%) will be hit hardest by the collapse

of global activity. Since a significant share of output is intended for use by

foreign industry, the worldwide containment measures will lead to a reduction

of almost 15 points in Swedish output in April (Figure 3). The same holds for commercial

services: exposure to global production chains is hurting transport and warehousing

(-15%) and the business services sector (-11%). Ultimately, the containment

measures will have an impact mainly through their effect on intra-branch trade.

The

weakness of Swedish manufacturing, weighed down by international trade, seems

to be confirmed by the first hard data available. According to the Swedish Statistical Office, exports fell by 17% year-on-year, a

figure comparable to the decline in world trade as measured by the CPB for the

same month (-16% by volume). Given this situation, manufacturing output will be

17% lower in April than a year earlier.

What

could be said about domestic demand in Q2?

In

a context of widespread uncertainty, domestic demand may continue to suffer.

Indeed, Swedish households can legitimately question the consequences of the

shock for jobs – mainly in industry – described above. On the other hand, fear

of the epidemic could deter consumers from making certain purchases involving

strong social interactions, even in the absence of legal constraints. What do

Swedish data from the beginning of Q2 tell us about Swedish domestic demand?

In

Sweden, consumer spending fell in March (-5% year-on-year). Note that the

country’s precautionary guidelines and physical distancing measures were

introduced on 10 March. The fall steepened in April, after the measures had in

force for a full month (-10% year-on-year). The measures in place hit purchases

of clothing (-37%), transport (-29%), hotels and catering (-29%) and leisure

(-11%). While the data remain patchy, May’s retail sales, an indicator that

does not cover the entire consumer sector, suggest that sales were still in a

dire state in clothing stores (-32%). In addition, new vehicle registrations

continued to fall in May (-15% month-on-month and -50% year-on-year). Pending

more recent data on activity in the rest of the economy, the volume of hours

worked[7] in May remains very low in hotels and

catering (-50%), and in household services and culture (-18%), suggesting that

significant and long-lasting losses to business can be expected.

On

the positive side, the data show a trend towards the normalization of household

purchases in May for certain consumer items. As in other European countries,

the recovery was particularly strong in household goods, where retail sales

returned to their pre-Covid level, and in sporting goods, while food

consumption remained buoyant.

Ultimately,

the health precautions taken by Sweden since the onset of containment measures are

akin to those implemented in the rest of Europe since the gradual easing of the

lockdowns. While the shocks to the consumption of certain items are less severe

than those observed in France, it is noticeable that, in the context of the

epidemic, some consumer goods could be severely affected even in the absence of

administrative closures. In addition to the recessionary impact imported from

the rest of the world, Sweden will also suffer due to domestic demand, which is

expected to remain limited particularly in certain sectors. The Swedish case

suggests that clothing, automobile, hotel and catering, and household services

and culture could suffer a lasting shock even in the absence of compulsory measures.

According to data available in May, this shock could reduce household

consumption by 8 percentage points, which represents 3 GDP points. How lasting the

shock is will depend on the way the epidemic develops in Sweden and in the rest

of the world.

[1] The Swedish institutional framework

helps to explain in part this differentiated response, which focuses more on

individual responsibility than on coercion (see https://voxeu.org/article/sweden-s-constitution-decides-its-exceptional-covid-19-policy). The country’s low population density

could also help explain the difference in behaviour vis-à-vis the rest of

Europe but not in relation to its Scandinavian neighbours.

[2] This indicator attempts to synthesize

the containment measures adopted according to two types of criteria: first, the

severity of the restriction for each measure taken (closure of schools and of businesses,

limitation of gatherings, cancellation of public events, confinement to the

home, closure of public transport, restrictions on domestic and international

travel) and second, whether a country’s measures are local or more generalized.

For a discussion of the indicator see Policy brief 69.

[3] Booming exports in March 2020 (up 39% in value) driven by strong

demand for pharmaceuticals and IT offset the fall in Ireland’s domestic demand during

the first quarter.

[4] This post on the OFCE blog does not

focus on the effectiveness of Swedish measures with regard to containing the

epidemic. Mortality from Covid-19 is higher in Sweden than in its neighbours (Norway,

Finland, Denmark), suggesting that it has run more epidemiological risks. This is

provoking a debate that goes well beyond the purpose of this post, but which does

deserve to be raised.

[5] International trade may actually impact

growth more than expected due to constraints on international tourism. In 2018,

Sweden actually ran a negative tourism deficit of 0.6% of GDP (source: OECD

Tourism Statistics Database), which could have an effect on domestic

activity if travel remains limited, especially during the summer.

[6] Timmer, M. P., Dietzenbacher, E., Los, B.,

Stehrer, R. and de Vries, G. J. (2015), “An Illustrated User Guide to the World

Input–Output Database: The Case of Global Automotive Production”, Review of International Economics., 23: 575–605

[7] In May, the volume of hours worked was

down 8% year-on-year (after -15%). The recovery in hours worked in May was due mainly

to manufacturing and construction. The recovery was less pronounced or even non-existent

in business services.