The 2013 pension reform: the implicit contribution of pensioners’ purchasing power

By Stéphane Hamayon and Florence Legros

Less than three years after the official retirement age in France was raised in 2010-2011, a new pension reform was passed in early 2014.

This reform is described by its promoters as “sustainable and equitable”. However, only a few months after it passed, if we once again review the mid- and long-term balance of the pension system, we would have to conclude that this subject needs another look (see our article in the Revue de l’OFCE, no. 137, 2014). The suspected imbalance stems from a gap between the assumptions that prevailed in 2014 when the reform passed and the actual development of critical macroeconomic variables such as unemployment and productivity growth.

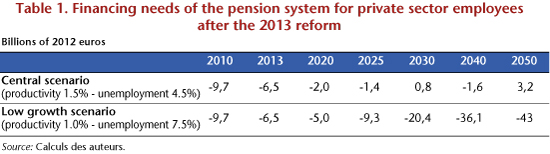

Our article begins with an analysis of the sensitivity of the overall balance of the pension scheme to economic variables and to the assumptions made. It shows that if the unemployment rate were to stabilize at 7.5% (the lowest rate in 30 years) and not 4.5% as in the scenario adopted by the reform, and productivity grew at a rate of 1%, which is in line with the reasonable estimates made by Caffet Artus (2013), instead of the 1.5% adopted, then this would lead to a continuing deterioration in the pension system accounts (Table 1).

Another variable that is examined precisely: the growth rate of productivity. Because this has an impact on wages, it plays an important role in rebalancing pension systems when the indexation of pensions and wages recorded in fictitious accounts for pension calculations (salaires portés au compte) is based on prices and not on wages. More specifically, high productivity would help balance the accounts, as resources would grow quickly while employment grow more slowly.

The consequence, however, is a relative impoverishment of pensioners relative to the working population, especially of older retirees for whom de-indexation will have cumulative effects.