Could France have a different fiscal policy?

By Jérôme Creel

Shouldn’t the economic crisis that is gripping the euro zone, including France, lead to calling into question the approach being taken by fiscal policy? In light of the unprecedented broad consensus among economists about the impact of fiscal policy on the real economy, it is clear that the austerity measures being adopted by France are a mistake. Moreover, invoking European constraints is not a good enough argument to exclude a much more gradual process of putting the public purse in order (also see the iAGS project).

There is no need to go beyond what European legislation requires, and doing so can be especially harmful if in fact the additional budgetary efforts generate less growth and, ultimately, further deterioration in the public finances due to higher social spending and lower tax revenue. What do the existing European treaties actually demand? In the case of a government deficit that exceeds 3% of GDP, the minimum effort required for fiscal adjustment consists of reducing the cyclically adjusted deficit, i.e. the structural deficit, by at least 0.5% of GDP per year. Furthermore, the time period for reducing the debt to 60% of GDP is 20 years. Finally, exceptional circumstances now include an “unusual event” that could justify deviating from the current standards for the deficit.

Based on these exceptional circumstances and on the rule requiring an annual improvement of at least 0.5% of GDP in the structural deficit, it can be shown that the French government has fiscal maneuvering room in 2012 and 2013, while still complying with European fiscal rules.

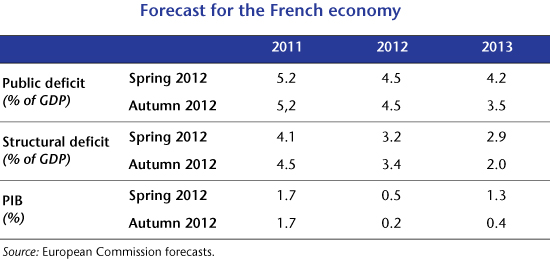

Table 1 lists the sequence of public deficits and of GDP growth from 2011 to 2013 according to two forecasts produced by the European Commission in the Spring and then the Autumn of 2012. According to the Spring forecast, the French structural deficit was supposed to decrease by 1.2% of GDP between 2011 and 2013, on average slightly above what is required by the Commission. In fact, the improvement from 2011 to 2012 exceeded 0.5% of GDP, while it fell below that from 2012 to 2013.

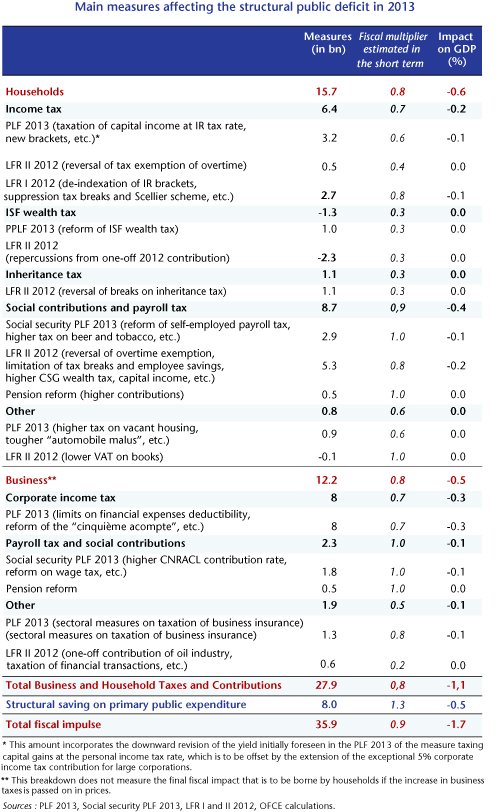

What about the Autumn 2012 forecast? The expected improvement in France’s structural deficit was now expected to be 1.1% of GDP between 2011 and 2012 and then 1.4% of GDP between 2012 and 2013, taking into account the government’s commitment to reduce public spending and raise taxes. These projected improvements in the structural deficit are two and three times greater than what European fiscal rules require, which is a lot! For the year 2013, this amounts to almost 20 billion euros that need not be levied on French households and businesses. Abandoning this levy does not mean abandoning fiscal austerity, but rather spreading it out over time.

Furthermore, the European Commission now expects a slowdown in the French economy in 2013. Unless one argues that the French government is responsible for this slowdown – and while this might indeed be the case in light of the austerity budget the government is imposing on the French economy, it is far from clear that the European Commission would want to employ such an argument, given its role in championing austerity! – this deterioration in the country’s growth prospects could fall within the category of an “unusual event,” thus giving France an opening to invoke exceptional circumstances in order to stagger and extend its fiscal adjustment efforts.

Instead of awaiting the miraculous effects of structural reform – a potentially lengthy and uncertain process – all that is really needed is to apply the regulations in force, without imposing an overly restrictive reading of what they contain, so as to limit the reduction in growth being caused by austerity and avoid a new period of rising unemployment. According to the conclusions of the iAGS report, staggering the fiscal austerity measures in France would lead to adding 0.7 GDP point to growth every year from 2013 to 2017.

The “unusual event” constituted by yet another year of very low growth in 2013 for France also opens the possibility of suspending the austerity policies, at least temporarily. Once again according to the findings of the iAGS report, the French government should put off till 2016 its policy of consolidating the public finances. The gain in terms of growth would be 0.9 percentage point per year between 2013 and 2017. Provided that this policy is actually conducted carefully and not postponed indefinitely, it would enable France to reduce its public debt to GDP ratio in compliance with existing EU treaties.