The British elections: border questions (2/2)

David Cameron has put the economy at the forefront of his electoral campaign, making the British economy’s good performance a trump card in the Conservative programme (see “The UK on the eve of elections …“). But, according to the polls, when May 7 comes to a close no party will be able to govern alone. While in 2010, the uncertainty was whether the Liberal Democrats would choose to ally with the Conservatives or the Labour Party, this time there is even greater uncertainty, as several parties are likely to be in a position to swing the outcome. The Liberal Democrats have lost popularity following five years of participation in government and are likely to receive less than 10% of the votes, behind the nationalist United Kingdom Independence Party (UKIP, with about 12% of voting intentions), which calls for the United Kingdom to leave the EU and won the last European elections. Faced with rising euro-scepticism, particularly in the ranks of his own Conservatives (the “Tories”), David Cameron has promised to hold a referendum on the UK’s membership in the EU by the end of 2017 if he becomes Prime Minister again. As for Labour, if it is able to form a coalition government, it could ally with the Scottish National Party (SNP). But Labour has excluded this possibility in the face of attacks by David Cameron, who has raised the spectre of the fragmentation of the UK among the British electorate, which has barely recovered from its fright at the possibility of seeing Scotland become independent in the September 2014 referendum. Labour would nevertheless benefit from the support of the SNP and could form a coalition with the Liberal Democrats. The Lib-Dems have drawn several red lines with respect to entering a coalition government: less fiscal austerity if they ally themselves with the Conservatives or more fiscal restraint if they join with Labour, except in education where the Liberal Democrats want more resources than the two major parties.

Economic and social programmes of the main parties: similarities, with some slight differences …

The Conservatives are welcoming the rebound in growth and employment, and have halved the public deficit relative to GDP in 2018/2019. They feel they have “put the house in order” and now want to “repair the roof while the sun is shining”. They say they want this to benefit everyone. They therefore want to increase spending on the health system (NHS), maintain spending on education and increase the number of places in university. They are committed to continue to raise pensions by at least 2.5% per year. They will make significant public investments in transport. They will not increase VAT, income tax, or social contributions. On the other hand, they will further reduce the cap on income assistance so as “to make work pay”.

The Conservatives want to promote apprenticeships, encourage business, regulate the right to strike, cut paperwork, and get disabled people into the workplace. They wish to control and reduce immigration from the EU (bringing it down to “tens of thousands” per year instead of “hundreds of thousands” now). The right to social benefits will be cut back (it will be necessary to have resided in the country for at least four years to qualify for tax credit and child benefit, and social housing will be reserved for British citizens). They want to provide cheap energy to households by developing energy savings and renewable energies, especially nuclear.

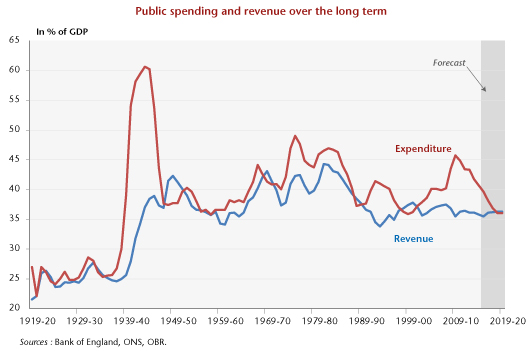

The Tories have set themselves the goal of bringing the public deficit into a small surplus (0.2 percent of GDP) through a combination of cutting public spending and social spending and combatting tax evasion and avoidance (taking action on non-domiciled status – “non-doms” – and the taxation of multinational firms).

For Labour, “Britain only succeeds when working people succeed”. A national renewal is needed so that “the economy works for working people”. Labour is denouncing the increase in inequality and in precarious jobs and the fall in the purchasing power of working families.

But the Labour Party is also proclaiming their commitment to reducing the public deficit every year. Their goal is to bring the current account deficit (excluding investment) into balance by 2018-19, which would mean a public deficit of 1.4% of GDP. This goal is less ambitious than that of the Conservatives and would be met in part by higher taxes. The maximum marginal rate of income tax would rise from 45% to 50%. A tax would be introduced on “mansions” (properties worth more than 2 million pounds). Labour has pledged to maintain the most competitive corporate tax rates in the G7. This rate, which was cut to 20% in April, would nevertheless be raised by one point. The levy on banks would be increased (900 million expected). Labour also wish to reinstate a lower 10% starting rate of tax, to be financed by the abolition of the allowance for married couples. They want to eliminate the very unpopular tax on vacant rooms (the “bedroom tax”). Like the Conservatives, they would remove the tax advantages for “non-doms”.

Labour, however, want to cut government spending, except on health, education and international development. They propose an increase in NHS funding in order to reduce waiting times. They have pledged to raise the hourly minimum wage to GBP 8.00 in 2019 (from the current level of 6.50 pounds, which is set to rise to 6.70 in October 2015). They propose to regulate zero-hour contracts (at least for employees who have worked regularly for more than 12 weeks). On the other hand, they do not question a cap on income assistance. Labour also say that they will control immigration and limit the right of immigrants to social benefits (by requiring at least two years’ residence in the country). They want to implement an industrial strategy to develop a green economy. They propose reducing the role of shareholders in corporate management and creating a British Investment Bank to help finance small businesses.

The Liberal Democrats call is for a “stronger economy, fairer society”. They want to make the UK a world leader in terms of future technologies. They want to increase spending on health and education. They also want to increase the availability of childcare and parental leave. Above all, they want to develop green taxation and make the transition to a low-carbon economy. They aim to balance the current budget, like Labour, but this would occur a year earlier (2017-2018). This would be achieved by limited spending cuts, but also by increasing taxes on the wealthy, on banks, on big business and pollution and by fighting tax avoidance. They too propose a mansion tax.

… and a number of unknowns

The Institute for Fiscal Studies (IFS) has published two notes: “Post-election austerity: Parties’ plans compared “, IFS Briefing Note BN 170, 22 April, and “Taxes and benefits: The parties’ plans”, IFS Briefing notes BN 172, 28 April. In these notes the IFS attempts to estimate the proposed measures, but underlines the lack of detail in the different programmes. The Conservatives are planning more spending cuts, while Labour and the Liberal Democrats are planning a less rapid reduction in deficits and consequently in public debt. Under the Tories, the public deficit would fall from 5% of GDP in 2014-15 to 0.6% in 2017-18, to 1.1% for the Liberal Democrats, to 2% for Labour, and to 2.5% for the SNP. The public debt would decline from 80% of GDP in 2014-15 to 72% in 2019-20 under the Conservative plan, compared with 75% for the Liberal Democrats, 77% for Labour and 78% for the SNP. The three parties have announced that they will pursue the goal of deficit reduction but without specifically detailing how they would do this. The Conservatives, for instance, would not increase taxes; they would have to make an 18% cut in spending on non-protected sectors, that is to say, defence, transportation, social assistance and justice. They do not spell out how they would make large savings on social welfare spending while excluding pensions and the NHS. At the end of April, the Liberal Democrats injected into the debate the idea that the Conservatives would consider reducing family allowances, which David Cameron has denied he will do, but suspicion remains just a few days before the election. All the parties have committed not to increase the main VAT rate, income tax or health insurance contributions, but all of them are also counting on a great deal of revenue from the fight against tax avoidance.

Scotland-Europe: two key issues in the elections

Two issues make this vote unique and have given rise to a very specific political configuration. First, the Scottish National Party (SNP) is continuing to call for Scotland’s independence, despite the outcome of the referendum in September 2014 (55% no). As a centre-left party that is currently in power in Edinburgh, it could win 55 of the 59 Scottish seats, at the expense of the Labour party, and thus be in a pivotal position for securing a future majority. It is calling for a new referendum on Scottish independence, but also for an end to austerity policies on public and social welfare spending.

UKIP is calling for the UK to leave the EU. David Cameron has promised to hold a referendum on this before the end of 2017 if the Conservatives prevail. In any case, Cameron is opposing any extension of Europe’s economic or political powers; Europe must above all be a single market that needs for free market policies to be maximized; he rejects any European regulations on financial services as well as any solidarity between countries, any increase in the EU budget, and any increase in the British contribution (“I am not paying that bill”). He wants the UK to have the possibility of limiting the social rights of EU immigrants, which would be the main point in any Conservative negotiations over keeping the United Kingdom in the EU. David Cameron will not come out for keeping the UK in the EU until these demands are taken into account. Labour has denounced the UK’s loss of influence in Europe caused by its isolationism, but it is also demanding less Europe: the UK should remain free to set its own immigration policy and social policy. According to Gordon Brown, leaving the EU would transform the UK into a “new North Korea”, without allies and without influence. Labour would hold a referendum if Europe wanted to impose unacceptable measures on the UK. The Liberal Democrats are very attached to Europe. They want to defend business in Europe, along with the Transatlantic Trade and Investment Partnership (TTIP), eliminate unnecessary institutions such as the European Economic and Social Council and the sessions of the EU Parliament in Strasbourg. They want to maintain freedom of movement in Europe but reduce immigrants’ rights to benefits. They will vote no on a referendum for leaving the EU. Currently, 35% of the British people would vote for leaving the EU and 57% against (but 38% want to stay while reducing the EU’s powers). The large corporations and even more so the City want to remain in a big market. As was the case during the Scottish referendum, some corporations (e.g. HSBC[1]) are threatening to move their headquarters if the UK leaves the EU. The richest and best-educated part of the population also wants to stay in the EU.

The UK’s economic and political development is thus now subject to three uncertainties: the risk that there will be no clear majority in Westminster; the return of the Scottish debate; and the debate on leaving the European Union.

[1] But HSBC is also challenging the increase in taxes on banks as well as the regulations inspired by the Vickers report, which would require ring-fencing the activities of the commercial banks.