How to reform the reduction on payroll taxes?

By Mathieu Bunel, Céline Emond, Yannick L’Horty

More than 20 billion euros are spent every year by the State to compensate the general exemptions from social security contributions, making this the leading employment policy plank in France, both in terms of the total budget and the numbers concerned – more than one employee out of two benefits from the reduction in contributions. In these times of fiscal pressure and the inexorable upward trend in unemployment, questions are being raised about the sustainability of such a scheme, whose scale, which was unified by the 2003 Fillon reform, consists of a reduction that shrinks as the wage rises, up to the level of 1.6 times the minimum wage (SMIC). At the level of the SMIC, the reduction comes to 26 points (28 points for firms with fewer than 20 employees).

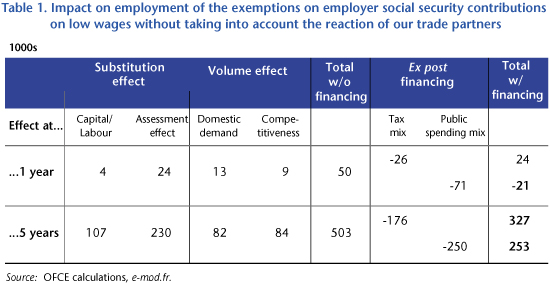

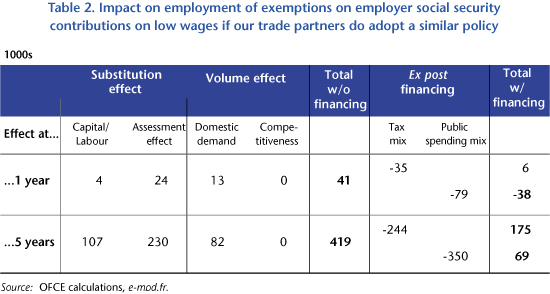

In an article published in the Revue de l’OFCE (Varia, no. 126, 2012), we evaluate the impact of a complete removal of the general exemptions as well as of a number of partial reforms of the thresholds for exemption from social security contributions, using the latest data suited to the analysis. In our estimate, the simple elimination of all general exemptions would lead to the destruction of about 500,000 jobs. We also explore the effects of reorganising the exemption thresholds, by screening a number of possibilities that would affect the various parameters that define the exemption arrangements. In every case, a reduction in the amount of exemptions would have a negative impact on employment, but the extent of the job losses would vary from simple to double depending on the terms of the reform. To ensure the least negative effect would require that the reductions in the exemptions spare the sectors that are most labour-intensive, which means better treatment for the exemption schedules that are most targeted at low wages. Since the goal is to improve the unemployment figures, it is important to concentrate the exemptions on lower wages, and thus to give a boost to the sectors that are richest in terms of labour.

However, concentrating exemptions too much in the vicinity of the minimum wage would increase the cost to employers of granting wage rises, which would be favourable neither to purchasing power nor to the quality of the jobs that condition future employment. While a new balance can always be sought in order to meet the urgent budget situation, to be sustainable it must be good for today’s jobs without neglecting those of the future.