France: the rise in cyclical unemployment continues

By Bruno Ducoudré

The Great Recession, which began in 2008, has resulted in a continuous and inexorable rise in unemployment in France, by 3.1 percentage points between the low point reached in the first quarter of 2008 (7.1% in mainland France) and the peak in the fourth quarter of 2012. The unemployment rate is now close to the record levels reached in the late 1990s. This rise can be broken down into a change in the rate of cyclical unemployment due to the lack of economic growth, and a change in the rate of structural unemployment. The latter gives information on the extent of the output gap, which is crucial for measuring the structural deficit. Consequently, any choice about the fiscal policy to be adopted to re-balance the public finances needs an analysis of the nature of the additional unemployment generated by the crisis. In other words, has the crisis mainly resulted in cyclical unemployment or structural unemployment?

A study of the Non-Accelerating Inflation Rate of Unemployment (NAIRU)[1] offers one way of analysing whether the unemployment is structural or cyclical. Based on an estimate of the wage-price spiral, we propose in the OFCE’s 2013-2014 forecasts for the French economy taking a look at the level of the equilibrium rate of unemployment (ERU) using a recursive estimate of the NAIRU since 1995 in order to identify the share of cyclical unemployment.

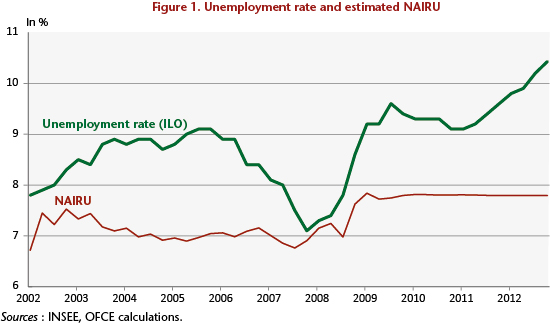

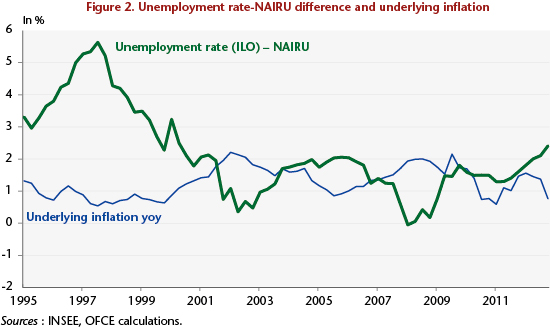

First, our estimate of the ERU takes good account of the lack of real inflationary pressures since 1995. Indeed, the actual unemployment rate is consistently higher than the ERU over this period (Figure 1). However, between 1995 and 2012 underlying inflation varies between 0 and 2%. It reaches 2% in 2002 and 2008, times when the actual unemployment rate is closer to the ERU, although this does not reflect the real inflationary pressures. In 2012, the increase in the unemployment rate led to a wider gap with the equilibrium rate of unemployment and was accompanied by a slowdown in underlying inflation, which fell below 1% by the end of the year.

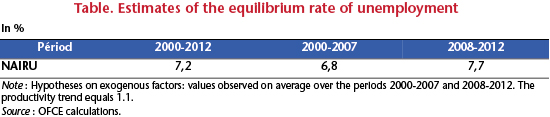

Second, the NAIRU is estimated at 7.2% on average over the years 2000-2012, with an average inflation rate of 1.9% over the period. Inflation rose to an average 7.7% over the period 2008-2012 (Table 1) and to 7.8% in 2012 (Figure 1).

Third, these estimates also indicate that the NAIRU has increased by 0.9 percentage points since the onset of the crisis. This explains at most 30% of the rise in the unemployment rate since 2008, with the remainder coming from an increase in cyclical unemployment. The cyclical component of unemployment would therefore represent 2.1 percentage points of unemployment in 2012. This change in the gap between the actual unemployment rate and the equilibrium rate of unemployment is also consistent with underlying inflation, which has been declining since 2009. Given our forecast of unemployment, this gap will increase by 1.5 percentage points, to a level of 3.6% in 2014 on an annual average.

Estimates of the equilibrium rate of unemployment thus indicate that the gap with the actual unemployment rate has widened during the crisis. The share of cyclical unemployment has increased, with the rise in cyclical unemployment accounting for about 70% of the rise in the unemployment rate since 2008. This confirms our diagnosis of a high output gap for the French economy in 2012, a gap that will continue to widen in 2014 under the combined impact of fiscal austerity and a high fiscal multiplier.

This text draws on the analysis of the economic situation and the forecast for 2013-2014, which is available [in French] on the OFCE site.

[1] The NAIRU is the rate of unemployment at which the inflation rate remains stable. Above it, inflation slows, which eventually makes possible an increase in employment and a reduction in unemployment. Below it, the dynamic is reversed, leading to higher inflation, a fall in employment and a return of unemployment to its equilibrium level.