What impact will fiscal policy have on French growth?

By Eric Heyer

The proper framework for analyzing the French economy is a large economy that is not very open, and not a small open economy: the country’s economic situation has deteriorated sharply and is still far from its equilibrium position (mass unemployment, the existence of excess capacity), and its European neighbours are adopting identical approaches to fiscal policy. Under these conditions, everything indicates that the fiscal multipliers are high. The theoretical debate about the value of the multiplier and the role of agents’ expectations must therefore give way to the empirical evidence: the multipliers are positive and greater than one.

Following a deep recession, the most suitable method for making a forecast of short-term activity (2 years) is to evaluate the spontaneous return of the economy (speed and magnitude) to its equilibrium or potential level, but also and above all to quantify the impact of exogenous shocks (commodity prices, economic policy, etc.) on its spontaneous trajectory.

In our last forecast, we reported that the French economy has a significant rebound potential: corresponding to spontaneous growth of nearly 4% per year in 2011 and 2012, this would allow the economy, four years after the start of the crisis, to make up the output gap built up during that period.

Two exogenous shocks will slow down the country’s return to its potential level. The first involves the soaring prices of raw materials: this shock will mainly hit households and will weigh on their purchasing power and curtail their spending. This mechanism, which is also at work in the other Western countries, will cause a slowdown in their economies and hence their demand for French output. In aggregate, this purchasing power shock will cut the growth of the French economy by 1 point during the period 2011-2012. The second shock is related to fiscal policy: from 2011 onwards, the large (and small) developed countries, in the face of mounting debt and expanding government deficits, will be implementing policies of fiscal restraint. The generalization of this strategy will also put the brakes on economic growth; its impact is estimated at 2.8 percentage points of GDP during the years 2011-2012.

While there is relative agreement on evaluating purchasing power shocks, this is not the case for the impact of fiscal policy on economic activity.

What is the value of the fiscal multiplier?

Economic thought has been divided since the Great Depression over how to assess the impact of fiscal policy. Two major theoretical schools in the history of economic thought are at odds over the expected short-term impact of fiscal policy on economic activity.1 On the one hand, the “Keynesian” school holds that an increase of one percentage point of GDP in public spending (or an equivalent decrease in taxes) should result in an increase in GDP of more than one point. This is known strictly as the Keynesian multiplier effect. On the other hand, there are a number of theoretical arguments that question the ability of fiscal policy to generate a more than proportional increase in GDP. Within this opposing school, it is then necessary to distinguish between those in favour of a positive fiscal multiplier (albeit less than one) and those in favour of a negative fiscal multiplier; in the latter case, we are speaking strictly of anti-Keynesian fiscal multipliers.

Many empirical studies have attempted to settle this theoretical debate. A review of the literature on this subject tells us that the fiscal multiplier is always positive, and that the following situations push it higher:

- The budget policies of the partner countries are synchronized;

- The instrument used relies more on public expenditure rather than taxation (Haavelmo, 1945);2

- Monetary policy is ineffective (IMF, 2010).3

In a recent article, the OFCE highlighted a fourth factor, which concerns the position in the economic cycle: the multiplier is higher when the economy is at the bottom of the cycle.

What can we say about the current economic situation?

The implementation of austerity policies in all the European countries (criterion 1), focused on reducing public expenditure (criterion 2), and acting in a situation of a persistent “liquidity trap” (criterion 3) describes the context for a high multiplier.

Only an assumption that the economic crisis did not simply cause a drop in production but also may have had a strong impact on the economic potential of the euro zone economies could render the current strategy of fiscal consolidation optimal (criterion 4): based on this assumption, the rise in structural unemployment would be identical to that of actual unemployment, and the fiscal multipliers would be low in the short term and zero in the long term.

If on the other hand the growth potential of the economies did not significantly change during the crisis, then this strategy would lose its apparent effectiveness, which would confirm the relevance of the first three criteria and strengthen the impact of the fiscal consolidation.

On this crucial point, the strong stimulus imparted by economic policy renders any evaluation of the economy’s new potential path more hypothetical and makes more complex the choice of a policy to end the crisis as well as the tempo of policy implementation. In any case, the violence of the initial shock can, it seems, lift any ambiguity about the case of the developed countries: even if it were agreed that this crisis has had a powerful impact on the economy’s growth potential, this would still not cancel out the overcapacity generated by the crisis over three years.

It is also possible to enrich the analysis by approaching it this time from the perspective of unemployment rather than production: unemployment rose brutally and spectacularly from the very start of the crisis, from 7.2% in early 2008 to 9.3% in late 2010. This increase in unemployment cannot be regarded as an increase in equilibrium unemployment: during this period, there were no significant changes in labour market institutions or practices, i.e. the main determinants of equilibrium unemployment. In the short term equilibrium unemployment could of course have been modified by a poor sector allocation of capital and labour resources. Some reallocation may also result from reduced productivity. But in any case there is no evidence of a lasting increase in equilibrium unemployment. The situation today is indeed a situation of involuntary unemployment as compared to what we could have seen, without inflation, with the full use of the available workforce.

Under these conditions all the evidence indicates that the multipliers are high: the country’s economic situation has deteriorated sharply and is still far from its equilibrium position (mass unemployment, the existence of excess capacity); monetary policy has little bite; and all the developed countries are in the same configuration and will therefore carry out the same policy.

The proper analytical framework is therefore that of a large, not very open economy, and not that of a small open economy. The theoretical debate about the value of the multiplier and the role of agents’ expectations must therefore yield to the empirical evidence: the multipliers are positive and greater than one.

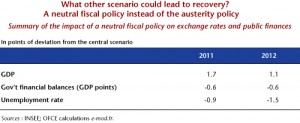

A simulation of a neutral budget policy indicates that the choice of fiscal consolidation proposed by the developed countries will thwart the start of a virtuous circle: without it, growth in “the Hexagon” would have been higher by 1.7 points in 2011 and 1.1 points in 2012 (Table 1). This would have allowed the unemployment rate to fall significantly (-1.5 point), eventually to 7.8% by 2012, close to the level prevailing before the crisis. The general government deficit would also have benefited from the boost in activity: it would have declined, although certainly less than in the case of the austerity policies set out (5 GDP points), reaching 5.6 GDP points in 2012 (Table 1). By raising the unemployment rate by 1.5 points compared to the baseline, i.e. the situation without a policy of fiscal restraint, the cost of a reduction of 0.6 GDP point in the general government deficit seems extremely high.

- In the long term, the effectiveness of fiscal policy vanishes. [↩]

- Haavelmo T. (1945), “Multiplier effects of a balanced budget”, Econometrica, vol. 13, no. 4, October, pp. 311-318. [↩]

- IMF (2010), “Recovery, Risk, and Rebalancing”, World Economic Outlook, Chapter 3, October. [↩]