Bank fragility: What consequences for economic growth and its relationship with bank loans?

Jérôme Creel and Fabien Labondance

The collapse of Silicon Valley Bank (SVB) has rekindled concern about the solidity of the US banking system and, via the danger of contagion, the European banking system. It offers a kind of case study of the complex relationship between banks and the economy.

SVB’s collapse came a few months after the Committee for the Alfred Nobel Memorial Prize in Economics, funded by the Royal Swedish Bank, awarded the 2022 prize to Ben Bernanke, Douglas Diamond and Philip Dybvig for their contributions to banking economics. In particular, Diamond and Dybvig explained the mechanisms by which a banking panic can occur (word of mouth is enough – economists speak of self-fulfilling prophecies), the difficulty of separating a solvency crisis from a liquidity crisis, and the measures to be implemented to stop it, i.e. by insuring deposits[1]. Bernanke showed the way that a banking panic can be transmitted to the real economy, thereby justifying the central bank’s implementation of a bank bailout. Their work undoubtedly helps to better understand the recent decisions of the US monetary authorities to contain the crisis triggered by SVB, such as the extension of deposit insurance.

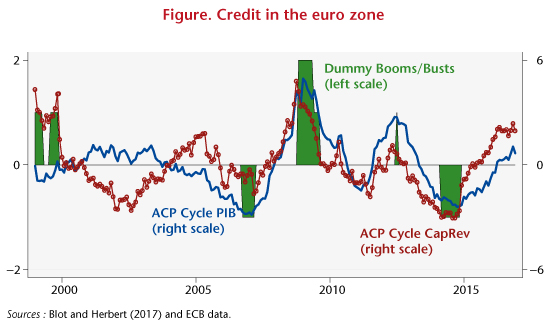

In addition to this work, an empirical consensus had emerged that economic growth, as measured by the change in GDP per capita, could be explained by the development of bank credit and the financial markets. The international financial crisis of 2007-2009 reshuffled the deck. The work of Gourinchas and Obstfeld (2012) and Schularick and Taylor (2012) (and much subsequent work) showed that the expansion of bank credit was a leading indicator of banking crises. However, the link between bank credit, bank fragility and prosperity remained to be established.

This is the link that we explore with Paul Hubert in a paper entitled “Credit, bank fragility and economic performance”, to be published in the Oxford Economic Papers. This paper examines the role of bank fragility in the relationship between private bank credit and economic growth in the European Union. We consider two types of bank fragility, one in terms of bank assets, and the other in terms of liability: the share of non-performing loans on the balance sheet and, in addition, the ratio of capital to assets, i.e. the inverse of leverage.

Our results are as follows. First, bank fragility, represented by non-performing loans, has a negative effect on economic growth: the higher their share of the balance sheet, the lower the growth of GDP per capita. Second, if bank fragility is included in the estimated model, in most specifications, bank credit has no effect on economic growth. The impact of credit on per capita economic growth seems to depend on the degree of bank fragility. Credit only has a positive and significant effect on per capita economic growth in a sub-sample ending before 2008 – which is in line with previous literature – and when non-performing loans are relatively low, i.e. when bank fragility is limited. Conversely, when bank fragility is high, credit has no impact on growth, whereas non-performing loans have a significant negative effect[2].

Omitting a bank fragility variable in the relationship between bank credit and economic growth may therefore lead to erroneous conclusions about the economic impact of financial development.

The main implication of these empirical results is that closely monitoring and limiting non-performing loans – ex ante through prudent credit supply policies, or ex post through incentives to build up loan loss provisions – not only plays a prudential role at the bank level but also has an impact at the macroeconomic level. This monitoring of non-performing loans is critical for bank credit policy to have a positive impact on economic activity.

[1] See the critical summary of their work in the article by Hubert Kempf, “Diamond et Dybvig et la fragilité bancaire” [Diamond and Dybvig and Bank Fragility], forthcoming in the Revue d’économie politique.

[2] On the liability side, leverage has no impact on economic performance.