By Magali Dauvin and Raul Sampognaro, DAP OFCE

Since the Covid-19 pandemic’s arrival on the old continent, a number of countries have taken strict measures to limit outbreaks of contamination. Italy, Spain, France and the United Kingdom belatedly stood out with especially strict measures, including lockdowns of the population not working in key sectors. Sweden, in contrast, has distinguished itself by the absence of any lockdown. While public events have been banned, as in the other major European countries, there were no administrative orders to close shops or to impose legal constraints on domestic travel[1].

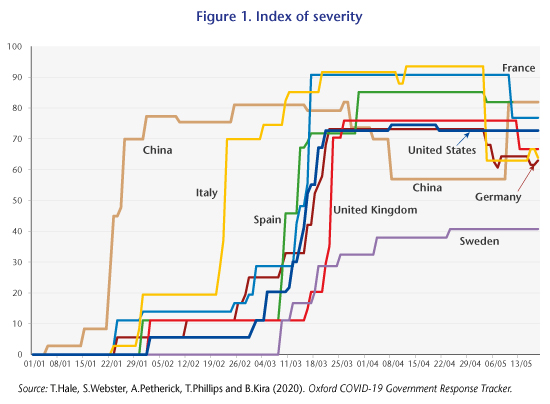

Given the multiplicity of measures and their qualitative nature, it is difficult to break down all the decisions taken, and in particular to express their intensity. Researchers at the University of Oxford and the Blavatnik School of Government have nevertheless built an indicator to measure the severity of government responses[2]. This indicator clearly shows Sweden’s specific situation with respect to the rest of Europe (Figure 1).

The mobility data supplied by Apple Mobility provides a complementary picture of the severity of containment measures across countries. At the time of the toughest lockdowns, automobile mobility was down by 89% in Spain, 87% in Italy, 85% in France and 76% in the United Kingdom. The decline was less severe in Germany and the United States (about 60% in both countries). Sweden ultimately saw its traffic reduced by “only” 23%. While these data should be taken with a grain of salt, they also give a clear signal about the timing and scale of the lockdowns in different countries, once again pointing to a Swedish exception.

During the first half of May, the various European countries began to gradually ease the measures taken to combat the spread of the Covid-19 epidemic.

Sweden’s GDP resists in Q1

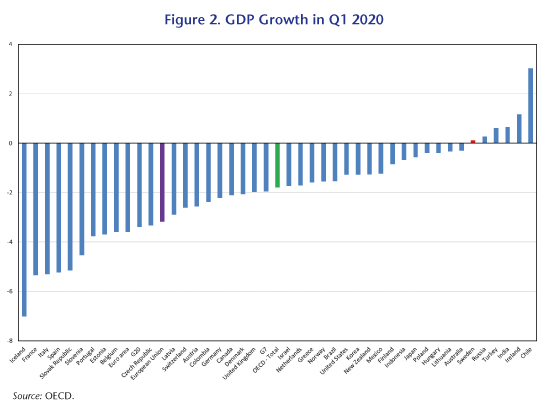

In our assessment of the impact of lockdowns on the global economy, we highlighted the correlation between the fall in GDP observed in the first quarter and the severity of the measures put in place to combat Covid-19. In this context, Sweden (in red in Figure 2) fares significantly better than the OECD member countries (green bar), and especially the rest of the European Union (purple bar). Although this is a first estimate, GDP has not only held up better than elsewhere, but has even stabilized (‑0.1%). Only a few emerging economies, which were not affected by the pandemic at the beginning of the year (Chile, India, Turkey and Russia), and Ireland, which benefited from exceptional factors, performed better in the first quarter [3].

The relative resilience of Sweden’s GDP in the first quarter seems to suggest that the country might have found a different trade-off between epidemiological and economic objectives compared to other countries[4]. However, this aggregate figure masks important developments that need to be kept in mind. In the first quarter, the stabilisation of Swedish GDP was due to the positive contribution made by foreign trade (up 1.7 GDP points) to a rise in exports (up 3.4% in volume terms), particularly in January, before any health measures were taken.

In the first quarter, Swedish domestic demand pulled activity downwards (by ‑0.8 GDP points due to household consumption and -0.2 GDP points due to investment), as in the rest of the EU. The shock to domestic demand was of course more moderate than in the euro area, where consumption contributed negatively to GDP by 2.5 points and investment by 0.9 points. Nevertheless, the physical distancing guidelines issued in Sweden must have had a significant impact during the first quarter.

In a troubled global context, Sweden will not be able to escape a recession

If we assume that the avoidance of a lockdown and the relatively limited administrative closures (confined to public events) did not give rise to any significant shock to domestic demand – which seems optimistic in view of the first quarter data – Sweden will nevertheless be hit hard by the shock to international trade[5].

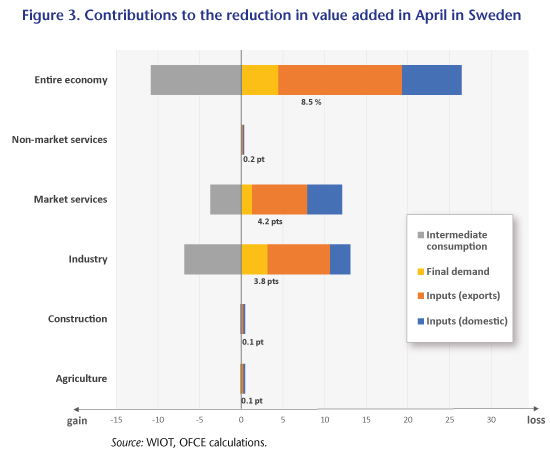

According to our calculations, based on the entry-exit tables from the World Input-Output Database (WIOD)[6] and our estimates related to the lockdown shocks in Policy Brief 69, value added is expected to fall by 8.5 points in Sweden in April due to the containment measures taken in the rest of the world. The shock will hit its industry especially hard, more or less in line with what we estimate globally (-19% and 21%, respectively). Unsurprisingly, the refining industry (-32%), the manufacture of transport equipment (-30%) and capital goods (-20%), and the other manufacturing industries sector (-20%) will be hit hardest by the collapse of global activity. Since a significant share of output is intended for use by foreign industry, the worldwide containment measures will lead to a reduction of almost 15 points in Swedish output in April (Figure 3). The same holds for commercial services: exposure to global production chains is hurting transport and warehousing (-15%) and the business services sector (-11%). Ultimately, the containment measures will have an impact mainly through their effect on intra-branch trade.

The weakness of Swedish manufacturing, weighed down by international trade, seems to be confirmed by the first hard data available. According to the Swedish Statistical Office, exports fell by 17% year-on-year, a figure comparable to the decline in world trade as measured by the CPB for the same month (-16% by volume). Given this situation, manufacturing output will be 17% lower in April than a year earlier.

What could be said about domestic demand in Q2?

In a context of widespread uncertainty, domestic demand may continue to suffer. Indeed, Swedish households can legitimately question the consequences of the shock for jobs – mainly in industry – described above. On the other hand, fear of the epidemic could deter consumers from making certain purchases involving strong social interactions, even in the absence of legal constraints. What do Swedish data from the beginning of Q2 tell us about Swedish domestic demand?

In Sweden, consumer spending fell in March (-5% year-on-year). Note that the country’s precautionary guidelines and physical distancing measures were introduced on 10 March. The fall steepened in April, after the measures had in force for a full month (-10% year-on-year). The measures in place hit purchases of clothing (-37%), transport (-29%), hotels and catering (-29%) and leisure (-11%). While the data remain patchy, May’s retail sales, an indicator that does not cover the entire consumer sector, suggest that sales were still in a dire state in clothing stores (-32%). In addition, new vehicle registrations continued to fall in May (-15% month-on-month and -50% year-on-year). Pending more recent data on activity in the rest of the economy, the volume of hours worked[7] in May remains very low in hotels and catering (-50%), and in household services and culture (-18%), suggesting that significant and long-lasting losses to business can be expected.

On the positive side, the data show a trend towards the normalization of household purchases in May for certain consumer items. As in other European countries, the recovery was particularly strong in household goods, where retail sales returned to their pre-Covid level, and in sporting goods, while food consumption remained buoyant.

Ultimately, the health precautions taken by Sweden since the onset of containment measures are akin to those implemented in the rest of Europe since the gradual easing of the lockdowns. While the shocks to the consumption of certain items are less severe than those observed in France, it is noticeable that, in the context of the epidemic, some consumer goods could be severely affected even in the absence of administrative closures. In addition to the recessionary impact imported from the rest of the world, Sweden will also suffer due to domestic demand, which is expected to remain limited particularly in certain sectors. The Swedish case suggests that clothing, automobile, hotel and catering, and household services and culture could suffer a lasting shock even in the absence of compulsory measures. According to data available in May, this shock could reduce household consumption by 8 percentage points, which represents 3 GDP points. How lasting the shock is will depend on the way the epidemic develops in Sweden and in the rest of the world.

[1] The Swedish institutional framework helps to explain in part this differentiated response, which focuses more on individual responsibility than on coercion (see https://voxeu.org/article/sweden-s-constitution-decides-its-exceptional-covid-19-policy). The country’s low population density could also help explain the difference in behaviour vis-à-vis the rest of Europe but not in relation to its Scandinavian neighbours.

[2] This indicator attempts to synthesize the containment measures adopted according to two types of criteria: first, the severity of the restriction for each measure taken (closure of schools and of businesses, limitation of gatherings, cancellation of public events, confinement to the home, closure of public transport, restrictions on domestic and international travel) and second, whether a country’s measures are local or more generalized. For a discussion of the indicator see Policy brief 69.

[3] Booming exports in March 2020 (up 39% in value) driven by strong demand for pharmaceuticals and IT offset the fall in Ireland’s domestic demand during the first quarter.

[4] This post on the OFCE blog does not focus on the effectiveness of Swedish measures with regard to containing the epidemic. Mortality from Covid-19 is higher in Sweden than in its neighbours (Norway, Finland, Denmark), suggesting that it has run more epidemiological risks. This is provoking a debate that goes well beyond the purpose of this post, but which does deserve to be raised.

[5] International trade may actually impact growth more than expected due to constraints on international tourism. In 2018, Sweden actually ran a negative tourism deficit of 0.6% of GDP (source: OECD Tourism Statistics Database), which could have an effect on domestic activity if travel remains limited, especially during the summer.

[6] Timmer, M. P., Dietzenbacher, E., Los, B., Stehrer, R. and de Vries, G. J. (2015), “An Illustrated User Guide to the World Input–Output Database: The Case of Global Automotive Production”, Review of International Economics., 23: 575–605

[7] In May, the volume of hours worked was down 8% year-on-year (after -15%). The recovery in hours worked in May was due mainly to manufacturing and construction. The recovery was less pronounced or even non-existent in business services.

Leave a Reply