by Jérôme Creel (OFCE & ESCP Business School) [1]

On 27 May, the European Commission proposed the creation of a new financial instrument, Next Generation EU, endowed with 750 billion euros. The plan rests on several pillars, and will notably be accompanied by a new scheme to promote the revival of activity in the countries hit hardest by the coronavirus crisis. It comes on top of the Pandemic Crisis Support adopted by the European Council in April 2020. A new programme called the Recovery and Resilience Facility will have firepower of 560 billion euros, roughly the same amount as the Pandemic Crisis Support. The Recovery and Resilience Facility stands out, however, for two reasons: first, by the fact that part of its budget will go to grants rather than loans; and second, by its much longer time horizon.

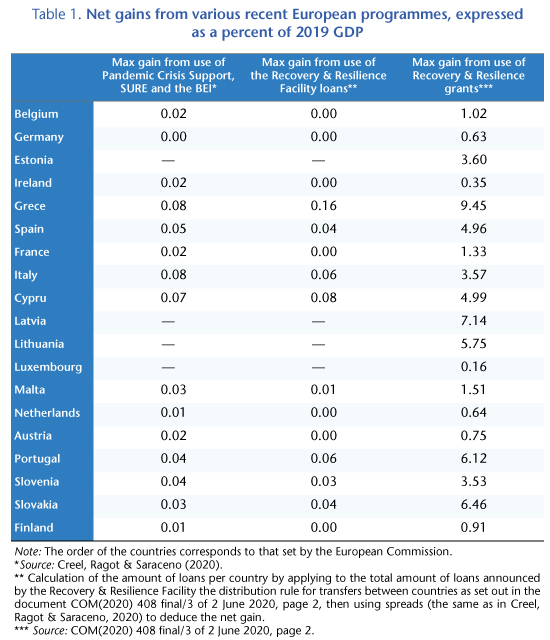

The Pandemic Crisis Support (and the complementary tools adopted at that time, see Creel, Ragot & Saraceno, 2020) consists exclusively of loans, and the net gains that the Member States could draw from them are by definition low: European loans allow a reduction in interest charges for States subject to high interest rates on the markets. The gain for Italy, which was hurt badly by the coronavirus crisis, is in the range of 0.04 to 0.08% of its GDP (this is not a typo!).

Under the Recovery and Resilience Facility, the euro zone Member States would share 193 billion euros in loans and 241 billion euros in grants, or in total 78% of the amounts allocated (the rest will go to EU states that are not euro zone members). The loans will generate small net gains for Member States (savings on the infamous interest rate spreads), while the grants will lead to larger gains, since they will not be subject to repayment, other than via higher contributions between 2028 and 2058 to the European budget (if the EU’s own funds have not been created or increased by then). In the short term, in any case, the grants received represent net gains for the beneficiaries: they will neither need to issue debt nor pay interest charges on such debt.

Expressed as a percentage of 2019 GDP, the net gains from grants are far from negligible (Table 1)[2]: 9 GDP points for Greece, 6 for Portugal, 5 for Spain and 3.5 for Italy. This will be even more significant given the expected fall in GDP in 2020. The determination of the Commission is therefore clear.

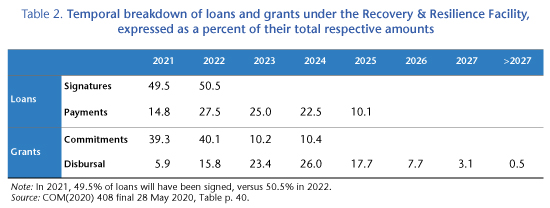

Despite all this, these grants are not intended to be used in the short term. The European Commission purportedly wanted the allocated amounts to be spent as quickly as possible, in 2021, 2022 and in any case before 2024. This is what it calls “front-loading”: do not put off till the morrow what can be done today. Except that the key to the distribution of the grant expenditures over time is somewhat in contradiction with this principle (Table 2). The grant commitments would be concentrated in 2021 and 2022, but the actual disbursals are planned for later: less than a quarter by 2023, half in 2023 and 2024, and the remainder after that. This kind of gap is frequent: it takes a little time to design an investment project and to ensure that it complies with the European Commission’s digital ambitions and low-carbon economy.

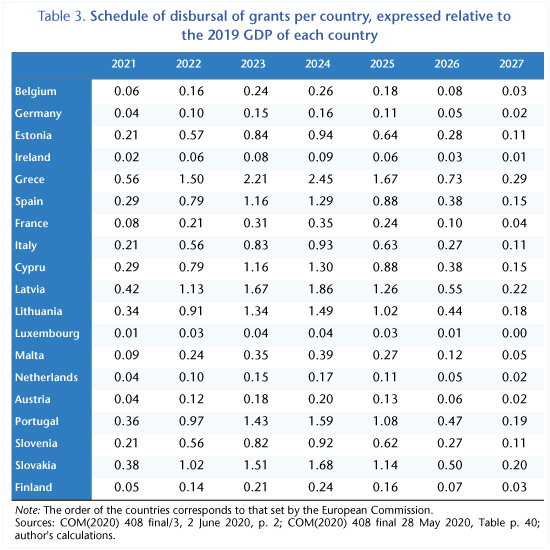

As a result, the grants to the Member States will take a little time to actually be disbursed (Table 3), and the countries facing the greatest difficulties will have to be resilient before receiving the stimulus and… resilience funds. This seems contradictory. It will take until 2022 in Greece and Portugal and 2023 in Spain and Italy to actually collect around 1 GDP point apiece. This corresponds to 3 billion euros for Greece, 2 billion for Portugal, and 14 for Spain and Italy, respectively. By way of comparison, Germany, France and the Netherlands will by then receive 5, 7 and 1 billion euros, respectively, i.e. between 0.2 and 0.3 percent of their GDPs.

One can imagine the cries of outrage from the representatives of the frugal countries (Austria, Denmark, the Netherlands, Sweden) that these immense outgoings reward countries that are not virtuous. They should be reassured: this is no boondoggle!

[1] This text appeared in the 23 May 2020 edition of Les Echos, without the tables.

[2] The rule for the distribution of transfers between countries appears in the document COM (2020) 408 final/3 of 2 June 2020. For each country it depends on the size of its population, on the inverse of GDP per capita compared to the EU-27 average, and on the difference between its 5-year unemployment rate and the EU-27 average. In order to avoid an excessive concentration of grants to a few countries, ad hoc limits are imposed based on these three criteria. Germany will for example receive 7% of the transfers, France 10%, and Spain and Italy 20%, respectively.

Leave a Reply