Public debt: Central banks to the rescue?

By Christophe Blot and Paul Hubert

In response to the health and economic crisis,

governments have implemented numerous emergency measures that have pushed public

debt up steeply. They have nevertheless not experienced any real difficulty in

financing these massive new issues: despite record levels of public debt, the

cost has fallen sharply (see Plus ou moins de

dette publique en France ?, by Xavier

Ragot). This trend is the result of

structural factors related to an abundance of savings globally and to strong

demand for secure liquid assets, characteristics that are generally met by

government securities. The trend is also related to the securities purchasing programmes

of the central banks, which have been stepped up since the outbreak of the

pandemic. For the year 2020 as a whole, the European Central Bank acquired

nearly 800 billion euros worth of securities issued by the governments of the

euro zone countries. In these circumstances, the central banks are holding an

increasingly high fraction of the debt stock, leading to a de facto

coordination of monetary and fiscal policies.

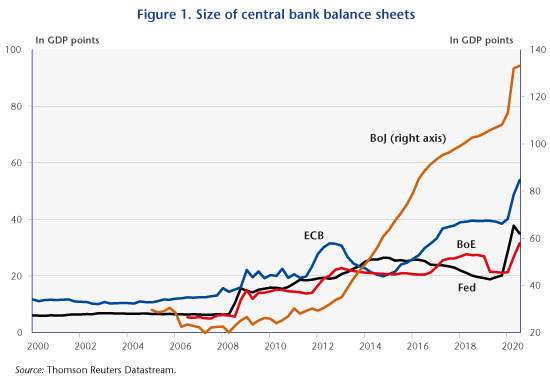

Back in 2009, central banks launched asset purchase

programmes to reinforce the expansionary impact of monetary policy in a context

where the banks’ key interest rates had reached a level close to 0%[1]. The stated objective was mainly to ease financing

conditions by holding down long-term interest rates on the markets. This

resulted in a sharp increase in the size of the banks’ balance sheets, which

now represents more than 53 GDP points in the euro zone and 35 points in

the United States, with the record being held by the Bank of Japan, at 133 GDP points

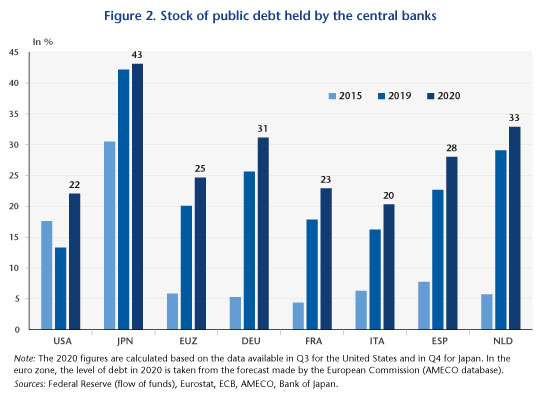

(Figure 1). These programmes, financed by issuing reserves, have focused heavily on government securities,

meaning that a large proportion of the stock of government debt is now held by

central banks (Figure 2). This proportion reaches 43% in Japan, 22% in the

United States and 25% in the euro zone. In the euro zone, in the absence of

euro bonds, the distribution of securities purchases depends on the share of

each national central bank in the ECB’s capital. The ECB’s distribution key stipulates

that the purchases are to be made pro rata to the share of the ECB’s capital

held by the national central banks[2]. Consequently, the purchases of securities are

independent of the levels and trajectories of public debt. As the latter are

heterogeneous, there are differences in the share of public debt held by the

national central banks [3]. Thus, 31% of Germany’s public debt is held by the

Eurosystem compared to 20% of Italy’s public debt.

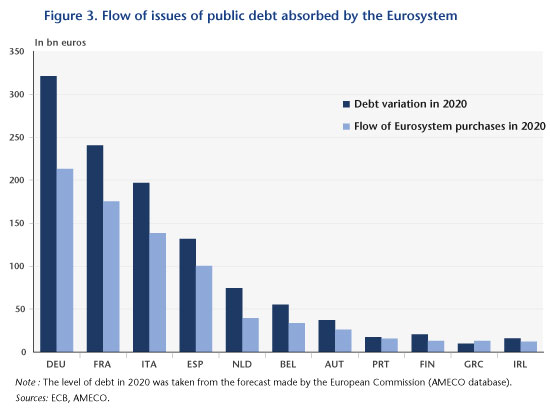

The decentralization of fiscal policies in the euro zone is also leading to tensions in the sovereign debt markets of some member countries, as seen between 2010 and 2012 and more recently in March 2020. This is why Christine Lagarde has launched a new asset purchase programme called the Pandemic emergency purchase programme (PEPP). While the distribution key is not formally abolished, it may be applied more flexibly in order to allow the ECB to reduce the sovereign spreads between member countries. Analysing the flows of securities purchases made by the euro zone central banks and the debt issues of the member states, it can be seen that the Eurosystem has absorbed on average 72% of the public debt issued in 2020, i.e. 830 billion euros out of the 1155 billion of additional public debt. The share amounts to 76% for Spain, 73% for France, 70% for Italy and 66% for Germany (Figure 3).

Unlike purchases made under the APP programme,

which aim to hit the inflation target, the PEPP’s objective is first and

foremost to limit rate spreads, as Christine Lagarde reminded us on 16 July 2020.

In fact, even if there is a structural downward trend in interest rates, some

markets may be exposed to pressure. The euro zone countries are all the more

exposed as investors can arbitrate between the different markets without incurring

any exchange rate risks. This is why they may prefer German securities to

Italian securities, thereby undermining the homogeneous transmission of

monetary policy within the euro zone. In addition to arguments about the risk

of fragmentation, these operations also reflect a form of implicit coordination

between the single monetary policy and fiscal policies, providing countries

with the manoeuvring room needed to take the measures required to deal with the

health and economic crisis. By declaring on 10 December that the allocation

to the programme would increase to 1850 billion euros by no later than March

2022, the ECB sent a signal that it would maintain its support throughout the

duration of the pandemic[4].

[1] This policy, generally referred to as

quantitative easing (QE), was launched in March 2009 by the Bank of England and

the US Federal Reserve. Japan had already initiated this type of so-called

unconventional measure between 2001 and 2006, and resumed this approach in

October 2010. As for the ECB, the first purchases of securities targeted at

certain countries in crisis were made from May 2010. But it was not until March

2015 that a QE programme comparable to those implemented by the other major

central banks was developed.

[2] In practice, this share is relatively close

to the weight of each member country’s GDP in euro zone GDP.

[3] Securities purchasing operations are

decentralized at the level of the national central banks. Doing this reduces

risk-sharing within the Eurosystem since any losses would be borne by the

national central banks, unlike assets held directly by the ECB, for which there

is risk-sharing that depends on the share of each national central bank in the

ECB’s capital.

[4] The initial allocation was 750 billion euros,

which was increased in June 2020 by a further 600 billion. As of 31 December 2020,

securities purchases under the PEPP came to 650 billion.