On the procedure for macroeconomic imbalances

Since 2012, every year the European Commission analyses the macroeconomic imbalances in Europe: in November, an alert mechanism sets out any imbalances, country by country. Countries with imbalances are then subjected to an in-depth review, leading to recommendations by the European Council based on Commission proposals. With respect to the euro zone countries, if the imbalances are considered excessive, the Member state is subject to a macroeconomic imbalance procedure (MIP) and must submit a plan for corrective action, which must be approved by the Council.

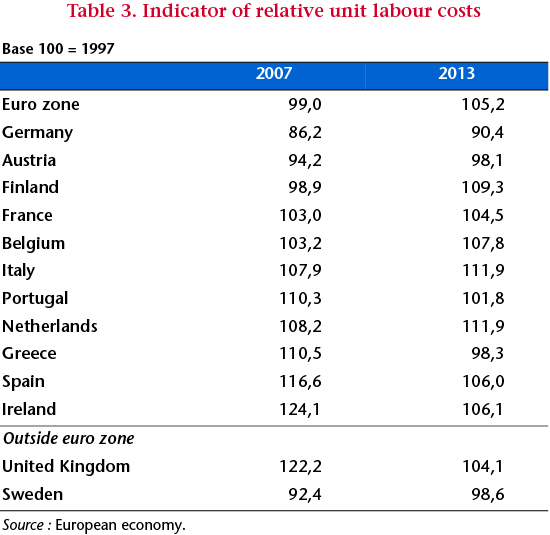

The alert mechanism is based on a scoreboard with five indicators of external imbalances [1] (current account balance, net international investment position, change in the real effective exchange rate, change in export market shares, change in nominal unit labour costs) and six indicators of internal imbalances (unemployment rate, change in housing prices, public debt, private debt, change in financial sector liabilities, credit flows to the private sector). An alert is issued when an indicator exceeds a certain threshold, e.g. 60% of GDP for public debt, 10% for the unemployment rate, -4% (+6% respectively) for a current account deficit (respectively surplus).

On the one hand, this process draws lessons from the rise in imbalances recorded before the crisis. At the time of the Maastricht Treaty, the negotiators were convinced that economic imbalances could only come from the way the State behaved; it therefore sufficed to set limits on government deficits and debt. However, between 1999 and 2007, the euro zone saw a steep rise in imbalances due mainly to private behaviour: financial exuberance, securities and property bubbles, swollen foreign deficits in southern Europe, and a frantic search for competitiveness in Germany. These imbalances became intolerable after the financial crisis, requiring painful adjustments. The MIP is thus designed to prevent such mistakes from happening again.

On the other hand, the analysis and the recommendations are made on a purely national basis. The Commission does not propose a European strategy that would enable the countries to move towards full employment while reabsorbing intra-zone imbalances. It does not take into account inter-country interactions when it demands that each country improve its competitiveness while cutting its deficit. The Commission’s recommendations are a bit like the buzzing of a gadfly when it proclaims that Spain should reduce its unemployment, France should improve its competitiveness, etc. Its proposals are based on a myth: it is possible to implement policies on public deficit and debt reduction, on wage austerity and on private debt reduction, while offsetting their depressive impact on growth and employment through structural reforms, which are the deus ex machina of the fable. This year there is also, fortunately, the European Fund for strategic investments (the 315 billion euros of the Juncker plan), meaning that the Commission can claim to be giving “a coordinated boost to investment”, but this plan represents at most only 0.6% of GDP over 3 years; its actual magnitude is thus problematic.

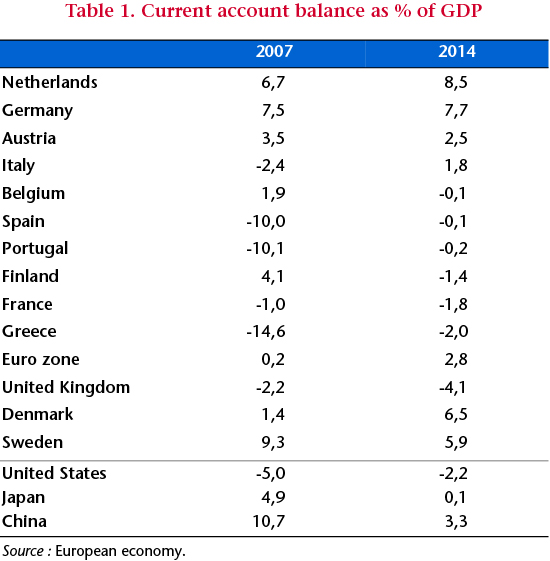

For 2015, all the countries in the European Union have at least one imbalance according to the scoreboard [2] (see here). France has lost too much of its export market share and has an excessive public debt and private debt. Germany, too, has lost too much of its export market share, its public debt is excessive and above all its current account surplus is too high. Of the 19 countries in the euro zone, seven, however, have been absolved by the Commission and 12 are subject to an in-depth review, to be published in late February. Let’s take a closer look at the German case.

On Germany’s surplus

A single currency means that the economic situation and policies of each country can have consequences for its partners. A country that has excessive demand (due to its fiscal policy or to financial exuberance that leads to an excess of private credit) and is experiencing inflation (which can lead to a rise in the ECB’s interest rate), thereby widening the euro zone’s deficit (which may contribute to a fall in the euro), requires its partners to refinance it more or less automatically (in particular via TARGET2, the system of automatic transfers between the central banks of the euro zone); its debt can thus become a problem.

This leads to two observations:

1. Larger countries can have a more harmful impact on the zone as a whole, but they are also better able to withstand the pressures of the Commission and its partners.

2. The harm has to be real. Thus, a country that has a large public deficit will not harm its partners, on the contrary, if the deficit makes up for a shortfall in its private demand.

Imagine that a euro zone country (say, Germany) set out to boost its competitiveness by freezing its wages or ensuring that they rise much more slowly than labour productivity; it would gain market share, enabling it to boost its growth through its trade balance while reining in domestic demand, to the detriment of its euro zone partners. The partners would see their competitiveness deteriorate, their external deficits widen, and their GDP shrink. They would then have to choose between two strategies: either to imitate Germany, which would plunge Europe into a depression through a lack of demand; or to prop up demand, which would lead to a large external deficit. The more a country manages to hold down its wages, the more it would seem to be a winner. Thus, a country running a surplus could brag about its good economic performance in terms of employment and its public account and trade balances. As it is lending to other member countries, it is in a strong position to impose its choices on Europe. A country that is building up deficits would sooner or later come up against the mistrust of the financial markets, which would impose high interest rates on it; its partners may refuse to lend to it. But there is nothing stopping a country that is accumulating surpluses. With a single currency, it doesn’t have to worry about its currency appreciating; this corrective mechanism is blocked.

Germany can therefore play a dominant role in Europe without having an economic policy that befits this role. The United States played a hegemonic role at the global level while running a large current account deficit that made up for the deficits of the oil-exporting countries and the fast-growing Asian countries, in particular China; it balanced global growth by acting as a “consumer of last resort”. Germany is doing the opposite, which is destabilizing the euro zone. It has automatically become the “lender of last resort”. The fact is that Germany’s build-up of a surplus must also be translated into the build-up of debt; it is therefore unsustainable.

Worse, Germany wants to continue to run a surplus while demanding that the Southern European countries repay their debts. This is a logical impossibility. The countries of Southern Europe cannot repay their debts unless they run a surplus, unless Germany agrees to be repaid by running a deficit, which it is currently refusing to do. This is why it is legitimate for Germany to be subject to an MIP – an MIP that must be binding.

The current situation

In 2014, Germany’s current account surplus represented 7.7% of GDP (or 295 billion euros, Table 1); for the Netherlands the figure was 8.5% of GDP. These countries represent an exception by continuing to run a strong external surplus, while most countries have come much closer to equilibrium compared with the situation in 2007. This is in particular the case of China and Japan. Germany now has the highest current account surplus of any country in the world. Its surplus would be even 1.5 GDP points higher if the euro zone countries (particularly those in Southern Europe) were closer to their potential output. Thanks to Germany and the Netherlands, the euro zone, though facing depression and high unemployment, has run a surplus of 373 billion dollars compared with a deficit of 438 billion for the United States: logically, Europe should be seeking to boost growth not by a depreciation of the euro against the dollar, which would further widen the disparity in trade balances between the euro zone and the United States, but by a strong recovery in domestic demand. If Germany owes its surplus to its competitiveness policy, it is also benefitting from the existence of the single currency, which is allowing it to avoid a surge in its currency or a depreciation in the currency of its European partners. The counterpart of this situation is that Germany has to pay its European partners so that they remain in the euro.

There are three possible viewpoints. For optimists, Germany’s surplus is not a problem; as the country’s population ages, Germans are planning for retirement by accumulating foreign assets, which will be used to fund their retirements. The Germans prefer investing abroad rather than in Germany, which they feel is less profitable. These investments have fuelled international financial speculation (many German financial institutions suffered significant losses during the financial crisis due to adventurous investments on the US markets or the Spanish property market); now they are fuelling European debt. Thus, through the TARGET2 system, Germany’s banks have indirectly lent 515 billion euros to other European banks at a virtually zero interest rate. Out of its 300 billion surplus, Germany spends a net balance of only 30 billion on direct investment. Germany needs a more coherent policy, using its current account surpluses to make productive investments in Germany, Europe and worldwide.

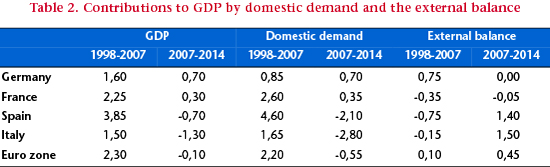

Another optimistic view is that the German surplus will decline automatically. The ensuing fall in unemployment would create tensions on the labour market, leading to wage increases that would also be encouraged by the establishment of the minimum wage in January 2015. It is true that in recent years, German growth has been driven more by domestic demand and less by the external balance than prior to the crisis (Table 2): in 2014, GDP grew by 1.2% in Germany (against 0.7% in France and 0.8% for the euro zone), but this pace is insufficient for a solid recovery. The introduction of the minimum wage, despite its limitations (see A minimum wage in Germany: a small step for Europe, a big one for Germany), will lead to a 3% increase in payroll in Germany and for some sectors will reduce the competitiveness gains associated with the use of workers from Eastern Europe. Even so, by 2007 (relative to 1997), Germany had gained 16.3% in competitiveness compared to France (26.1% compared to Spain, Table 3); in 2014, the gain was still 13.5% relative to France (14.7% relative to Spain). A rebalancing is taking place very slowly. And in the medium term, for demographic reasons, the need for growth in Germany is about 0.9 points lower than the need in France.

Furthermore, a more pessimistic view argues that Germany should be subject to a macroeconomic imbalance procedure to get it to carry out a macroeconomic policy that is more favourable to its partners. The German people should benefit more from its excellent productivity. Four points need to be emphasised:

1. In 2014, Germany recorded a public surplus of 0.6 percent of GDP, which corresponds, according to the Commission’s estimates, to a structural surplus of about 1 GDP point, i.e. 1.5 points more than the target set by the Fiscal Compact. At the same time, spending on public investment was only 2.2 GDP points (against 2.8 points in the euro zone and 3.9 points in France). The country’s public infrastructure is in poor condition. Germany should increase its investment by 1.5 to 2 additional GDP points.

2. Germany has undertaken a programme to reduce public pensions, which has encouraged households to increase their retirement savings. The poverty rate has increased significantly in recent years, reaching 16.1% in 2014 (against 13.7% in France). A programme to revive social protection and improve the prospects for retirement[3] would boost consumption and reduce the savings rate.

3. Germany should restore a growth rate for wages that is in line with growth in labour productivity, and even consider some catch-up. This is not easy to implement in a country where wage developments depend mainly on decentralized collective bargaining. This cannot be based solely on raising the minimum wage, which would distort the wage structure too much.

4. Finally, Germany needs to review its investment policy[4]: Germany should invest in Germany (public and private investment); it should invest in direct productive investment in Europe and significantly reduce its financial investments. This will automatically reduce its unproductive investments that go through TARGET2.

Germany currently has a relatively low rate of investment (19.7% of GDP against 22.1% for France) and a high private sector savings rate (23.4% against 19.5% for France). This should be corrected by raising wages and lowering the savings rate.

As Germany is relatively close to full employment, a significant part of its recovery will benefit its European partners, but this is necessary to rebalance Europe. Any policy suggested by the MIP should require a change in Germany’s economic strategy, which it considers to be a success. But European integration requires that each country considers its choice of economic policy and the direction of its growth model while taking into account European interdependencies, with the aim of contributing to balanced growth for the euro zone as a whole. An approach like this would not only benefit the rest of Europe, it would also be beneficial to Germany, which could then choose to reduce inequality and promote consumption and future growth through a programme of investment.

[1] For more detail, see European Commission (2012) : “Scoreboard for the surveillance of macroeconomic imbalances”, European Economy Occasional Papers 92.

[2] This partly reflects the fact that some of these indicators are not relevant: almost all European countries are losing market share at the global level; changes in the real effective exchange rate depend on trends in the euro, which the countries do not control; the public and private debt thresholds were set at very low levels; etc.

[3] The ruling coalition has already raised the pensions of mothers and allowed retirement at age 63 for people with lengthy careers, but this is timid compared with previous reforms.

[4] The lack of public and private investment in Germany has been denounced in particular by the economists of the DIW, see for example: “Germany must invest more for future”, DIW Economic Bulletin 8.2013 and Die Deutschland Illusion, Marcel Fratzscher, October 2014.