By Guillaume Allègre, @g_allegre

The Responsibility Pact, the CICE competitiveness tax break, reductions on social security charges … is it possible to reduce the evaluation of such measures to the cost in euros of each job created? While such an assessment is obviously important, the final figure is often subject to misinterpretation or misuse in the public debate, sometimes in perfectly good faith. For some commentators, a very high cost per job created, generally higher than the average real cost of a public (or private) job, represents a waste of public money that would be better used elsewhere, for nurseries, education or the national police.

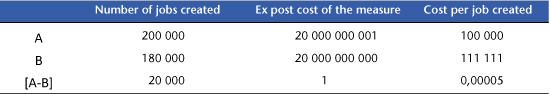

This kind of logic is based on a misinterpretation of the billions involved. To understand this, let’s do the following thought experiment: take two tax measures, A and B, which are intended to reduce the cost of labour in order to generate jobs. Measure A creates 200,000 jobs and costs the State and government ex post (that is to say, after taking into account the jobs created and interaction with the social security and tax systems) 20 billion and 1 euros. The cost per job created is thus 100,000 euros, which seems excessive. Measure B creates 180,000 jobs and has an ex post cost of 20 billion euros, 111,111 euros per job, which is even worse. At first glance, there’s no point in implementing either Measure A or B: the cost per job created is far too great. Now, suppose it is also possible to enact Measure –A or –B which, conversely to A and B, push up the cost of labour (through higher payroll taxes) with symmetrical effects on employment. Suppose also that the impact on employment and the cost are additive when two measures are implemented at the same time. It now seems clear that we should implement [A–B][1]: reducing the cost of labour by A and increasing it by –B would create 20,000 jobs for a cost of 1 euro, or 0.00005 euros per job created! The ratio of the cost of a job created between Measure A and Measure [A–B] is 2 billion to 1 (= 100,000/0.00005)! Someone not paying attention might then say: Measure A must certainly not be implemented.

Since Ricardo, economists have known that it is often the relative advantages that count and not the absolute advantages: alone, A is not of much interest, but combined with –B it is very powerful, just as in poker a 2 of Hearts in a hand does not have the same value when it is with Jacks as when it is with the 2s of Spades, Clubs and Diamonds. Economic policy measures cannot be evaluated in isolation: they must be evaluated in their interaction with all the instruments that have already been implemented or are simply there.

In addition to the failure to take into account macroeconomic dynamics and the financing, another limitation of reasoning in terms of cost per job created is that it does not always consider the questions: who pays the bill, and who gets what? Expenditures by the State (for childcare, education or the national police) are not equivalent to tax expenditures: if they are funded, the former reduce the disposable income of households, while the latter do not (they are a transfer between households, between businesses or between households and businesses). As a consequence, it is misleading to compare the two types of expenditure only in terms of jobs created. In effect, the jobs created are simply an indirect consequence of a tax expenditure (the direct effect is the transfer from the State to households and businesses); if the measure is funded, as in [A–B], the jobs created are a second-order effect related to the different behavioural responses to A and –B. In contrast, a structural increase in government spending (and therefore in the tax burden) has the first-order effect of increasing the consumption of public goods and reducing the consumption of private goods. If you reason only in terms of jobs, there is a risk of ending up with full employment but in a completely socialized economy. To evaluate this type of transfer, parameters other than job creation also need to be considered. In particular it is necessary to take into account well-being (what is the utility of nurseries or spending on education and national police versus private spending?) and incentive effects (what is the effect of higher social contributions on economic incentives to meet consumer needs?). It is also necessary to think in terms of the tax burden. [A–B] can create jobs only by organizing transfers within households and / or businesses. The relevant questions are therefore: who are the ex post winners and losers (taking into account the jobs created and changes in prices and wages)? Do these transfers reduce or increase inequality? Do they violate horizontal equity (equal taxation on equal abilities to pay)? Are they likely to affect long-term growth (via the structure of employment, capital-labour substitution, etc.)?