Reducing uncertainty to facilitate economic recovery

Elliot Aurissergues (Economist at the OFCE)

As

the health constraints caused by the pandemic continue to weigh on the economy

in 2021, the challenge is to get GDP and employment quickly back to their

pre-crisis levels. However, companies’ uncertainty about their levels of

activity and profits in the coming years could slow the recovery. In order to

cope with the possible long-term negative effects of the crisis, and weakened

by their losses in 2020, companies may seek to restore or even increase their

margins, which could result in numerous restructurings and job losses. Economic

recovery could take place faster if business has real visibility beyond 2021. While

it is difficult for the current government to make strong commitments, on the

other hand mechanisms that in the long term are not very costly for the public purse

could make it possible to take action.

Post-pandemic uncertainty will hold back a recovery

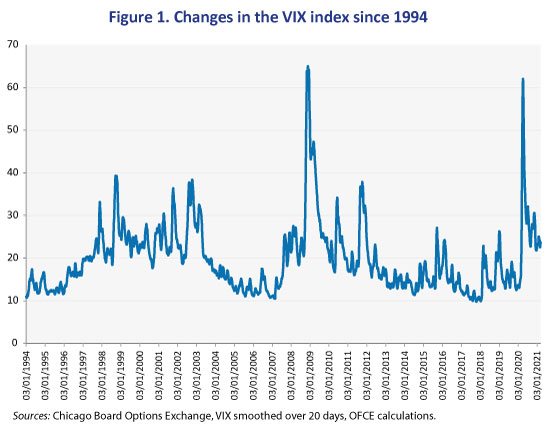

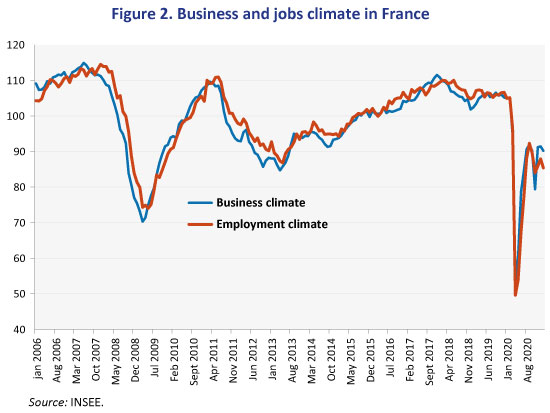

In economic terms, the pandemic represents an atypical crisis. It combines both goods and labour supply shocks and a fall – largely constrained – in consumption (Dauvin and Sampognaro, 2021). There are not many recent episodes that can provide useful points of comparison for economic actors. Some elements do indicate a rapid return to normalcy, including the dynamism of some Asian economies, in particular the Chinese economy, and the resilience of the US economy and the Biden administration’s economic policy. On the other hand, there are other factors that may limit economic growth in the coming years. The heavy losses of some companies could lead to a wave of bankruptcies (Guerini et al., 2020; Heyer, 2020), with possible negative effects on productivity or the employment of certain categories of workers. Some consumption patterns could be modified permanently, with a heavy impact on sectors like aeronautics and retailing. The trajectories of some of the emerging economies are another unknown, as they cannot afford the same level of fiscal support as do the US and Europe. Finally, the concentration of the shock on sectors that tend to employ low-skilled workers risks increasing inequalities within countries, and thus generating a further rise in global savings. Some indicators reflect this still high uncertainty. The VIX index, which captures market expectations for the volatility of US stock prices, remains twice as high as before the crisis and is comparable to the levels reached during the Dotcomcrisis (see Figure 1). In France, the business and jobs climate has rebounded strongly from its historical low in March-April 2020, but is still at the same level as during the low point of the eurozone crisis in 2012-2013 (see Figure 2).

The literature shows that uncertainty about the medium-term path of the economy affects the way companies behave today. By identifying uncertainty with stock price volatility, Bloom (2009) suggests that it has had a significant negative impact on GDP and employment in the US. A number of other studies have used different methodologies to confirm this idea [1]. Given the severity of the recession in 2020, uncertainty could have an even greater impact. Effects that are usually second-order may be enough to derail an economic recovery.

A proposal for giving visibility to businesses

The

measures in France’s current stimulus package basically focus on 2021 and 2022

and do not give any visibility to businesses about their activity or cash flow

beyond 2022. It is true that it is difficult for the current government to

commit to major expenditures that would have to be assumed by future

governments. However, it is possible to envisage relatively strong measures that

have limited budgetary costs over the next ten years (and therefore a limited

impact on the fiscal manoeuvring room of future governments).

Proposal: Give companies the following option: a subsidy of 10% of their wage bill (wages under 3x the minimum wage – the SMIC) between 2022 and 2026 in exchange for an additional tax of 5% on their gross operating profits (EBITDA) over the period 2022-2030.

For

firms applying for the scheme, this is the fiscal equivalent of a temporary

recapitalization. They exchange a subsidy today for a fraction of their

profits tomorrow. The implicit cost of capital would be particularly

attractive. The scheme is calibrated so that its “interest rate” (given by the

ratio between the sum of additional taxes over 2022-2030 and the sum of

subsidies over 2022-2026) is close to 0% for the “average” French company. This

rate would be lower a posteriori for companies that will have performed

less well than expected. Compared with other recapitalization methods such as

direct public shareholdings or the conversion of loans into quasi-equity, there

is no risk that the current shareholders will lose control of the company.

The

advantage of the scheme is that it automatically targets the companies that

face the greatest need. The businesses that anticipate possible economic

difficulties over the next few years and that have employment-intensive

activities will self-select, while others will have no interest in applying for

the subsidy. As the subsidy is disbursed gradually, companies that maintain

employment over the period will be favoured. Capital-intensive and high-growth

companies would not be penalized, as the scheme would remain optional. The

additional tax on EBITDA is temporary and should not have a negative impact on

investment by those applying for it.

The

cost in terms of public debt up to 2030 would be low: about 10 billion euros[2], or 0.4 percentage points of GDP, if all companies

were to apply. The self-selection effect of the scheme would increase the

average cost per beneficiary company but would also decrease the number of

beneficiaries, thereby having an ambiguous impact on the total cost. This does

not take into account the beneficial impact of the scheme on the public

finances in so far as it prevents job losses and the non-repayment of certain

guaranteed loans. The fiscal impulse over 2022-2025 could on the other hand be

quite strong, on the order of 1 to 1.5 GDP points per year (i.e. 4 to 6 GDP points

over the four years) but would be counterbalanced by an automatic increase in

revenue over 2025-2030[3].

Bibliography

Bachmann R., S. Elstner and E. Sims, 2013,

“Uncertainty and Economic Activity: Evidence from Business Survey

Data”, AEJ

macroeconomics, https://www.aeaweb.org/articles?id=10.1257/mac.5.2.217

Belianska A., A. Eyquem and C. Poilly, 2021, “The

Transmission Channels of Government Spending Uncertainty”, working paper, https://halshs.archives-ouvertes.fr/halshs-03160370

Bloom N., 2009, “The impact of uncertainty shocks”,

Econometrica, https://onlinelibrary.wiley.com/doi/abs/10.3982/ECTA6248

Dauvin M. and R. Sampognaro, 2021, “Behind the

Scenes of Containment: Modelling Simultaneous Supply and Demand Shocks”, OFCE working papers, https://www.ofce.sciences-po.fr/pdf/dtravail/OFCEWP2021-05.pdf

Fernandez-Villaverde J. and P. Guerron-Quintana,

2011, “Risk Matters: The Real Effects of Volatility Shocks”, American Economic Review, https://www.aeaweb.org/articles?id=10.1257/aer.101.6.2530

Fernandez-Villaverde J. and P. Guerron-Quintana,

2015, “Fiscal volatility shocks and economic activity”, American Economic Review, https://www.aeaweb.org/articles?id=10.1257/aer.20121236

Guerini M., L. Nesta, X. Ragot and S. Schiavo,

2020, “Firm

liquidity and solvency under the Covid-19 lockdown in France”, OFCE policy brief, https://www.ofce.sciences-po.fr/pdf/pbrief/2020/OFCEpbrief76.pdf

Heyer E., 2020,

“Défaillances d’entreprises et destructions d’emplois: une estimation de

la relation sur données macro-sectorielles”, Revue de l’OFCE, https://www.ofce.sciences-po.fr/pdf/revue/7-168OFCE.pdf

[1] Fernandez-Villaverde, Guerron-Quintana,

Rubio-Ramirez and Uribe (2011) show that increased interest rate volatility has

destabilizing effects on Latin American economies. In a 2015 paper, the same authors

suggest that increased uncertainty about future US fiscal policy leads firms to

push up their margins, reducing economic activity. This result has been confirmed

by Belianska, Eyquem and Poilly (2021) for the euro zone. Using consumer

confidence surveys, Bachmann and Sims (2012) show that pessimistic consumers

reduce the effectiveness of fiscal policy during a recession. Finally,

uncertainty among CEOs has a negative impact on output, as shown by German data

analysed by Bachmann, Elstner and Sims (2013).

[2] The total of wages below 3 SMICs in 2019 was

on the order of 480 billion euros (the total of gross wages and salaries came

to 640 billion for non-financial companies, and the latest INSEE data suggest

that wages below 3 SMICs represent 75% of the wage bill, an amount that seems

consistent with the data on the cost of France’s CICE tax scheme). The EBITDA

of non-financial companies was 420 billion euros. Based on these 2019 figures,

and if all companies were to apply for the scheme, the total subsidy would

amount to 0.1 x 480 x 4 or 196 billion euros. The EBITDA tax would under the

same assumptions yield 0.05 x 420 x 8 + 0.05 x 196 (5% of the subsidy will be

recovered viathe extra EBITDA) or 186 billion euros.

[3] This additional tax revenue should not penalize

activity over this period because (1) it will concern capital income for which

the marginal propensity to consume is rather low, and (2) the beneficiary

companies should be able to anticipate it correctly.