By Christophe Blot and Xavier Timbeau

In parallel with the decisions taken by the US Federal Reserve and the European Central Bank (ECB), governments are stepping up announcements of stimulus packages to try to cushion the economic impact of the Covid-19 health crisis, which has triggered a recession on an unprecedented scale and pace. The confinement of the population and the closure of non-essential businesses is leading to a reduction in hours worked and in consumption and investment, combining a supply shock and demand shock.

The responses to the crisis in both the US and Europe are unfolding over time, but the choices already made on either side of the Atlantic have lessons about their ideologies, the fundamental characteristics of their economies and the functioning of their institutions.

Federal budget: whether or not to have one

After several days of negotiations between Democrats and Republicans, the US Congress approved a plan to support the economy worth 2,000 billion dollars (9.3 points of GDP) [1]. It provides, in particular, for transfers to households, loans to SMEs and measures to support sectors in difficulty in the form of deadline extensions. On the other side of the pond, the European Commission has proposed the creation of a 37-billion euro fund as part of an investment initiative. The EU will also reallocate one billion euros “as a guarantee to the European Investment Fund to incentivise banks to provide liquidity to SMEs and midcaps” [2]. EU-wide, these sums represent 0.2 percentage point of GDP, which may seem all the more derisory since this does not involve allocating additional funds but rather reallocating funds within the budget.

These major differences point out in the first place that, by construction, the European budget is limited, and that it is not set up to respond to an economic slowdown affecting all the Member States. Within the EU, fiscal prerogatives are the responsibility of the Member States, as are the main sovereign instruments for responding to a crisis.

It is the national budgets that are used to prop up economic activity. So turning to these and bringing together announcements made at the level of the EU’s five largest countries, the total sum allocated exceeds 430 billion euros (3.3% of GDP), to which must be added guarantees, which could come to more than 2,700 billion euros, or more than 20 points of EU GDP [3]. The measures taken by the US and by European countries are thus on a comparable order of magnitude and are distinguished by the level at which they are taken as well as by the way in which the sums are allocated. In the United States, the federal budget represents 33% of GDP, which makes it possible to carry out a common, centralized action that benefits all households and businesses, based on decisions approved by Congress, in a way that implicitly ensures stabilization between the different States. In practice, the taxes paid by households and businesses in the States hit hardest will fall relatively, and these same States will also be able to benefit more from certain federal measures. Moreover, the US Congress can vote a deficit budget, which can be used to implement intertemporal stabilization measures [4].

In contrast, the EU does not have the capacity to go into debt, whereas the Member States can. Their stabilization capacity can be constrained by the difficulty of self-financing, which initially leads to a rise in interest rates or subsequently to the drying up of markets. The different Member States are not on an equal footing in the markets, due to their macroeconomic situation or to the level of their debt, as in the case of Italy. But beyond these differences, the main issue is that savers, through the financial markets, can make trade-offs between the debts of different countries within a legal space (the EU) that guarantees the free movement of capital, so interest rate movements can amplify small macroeconomic differences and fuel self-actuating dynamics. The 2012 sovereign debt crisis showed that a contagion by sovereign rates, which, after Greece, sucked Italy and Spain into a whirlpool of doubt in the financial markets, could lead to substantial transfers from countries in difficulty to countries considered virtuous. The counterpart of the trade-off was the lowering of rates for Germany and France. These transfers can amount to several points of GDP, a level that is creating a risk of the break-up of the euro zone: it might be preferable to end the free movement of capital, so as to capture national savings to finance the public debt (and therefore monetize the public deficit) rather than letting the debt load soar and having to submit to a humiliating recovery plan in exchange for European aid.

The surge in Italian sovereign rates, prior to the clarification by the ECB’s announcement, then logically enough relaunched the debate about the possibility of issuing euro-bonds (called “corona-bonds”), which would make it possible to pool part of the budgetary expenditures of the euro zone States so as to avoid this wholly unjustified spiral of trade-offs between sovereign debts, whose impact could be sufficient to lead to the break-up of the euro zone.

As long as these common debt securities are not set up or the ECB is reluctant to intervene to buy back this or that European public debt, the role of Europe’s institutions will be on another scale. First of all, what is needed is to promote the coordination of decisions taken by the Member States and to encourage governments to take strong measures to avoid stowaways who expect to benefit from measures taken by their neighbours [5]. These effects are likely to be limited, however, and it is hard to imagine that a country will not take the steps necessary to directly help households and businesses cope with the shock.

More than coordination, it is essential to soften the fiscal rules announced and in force in order to give the Member States the manoeuvring room they need by invoking the exceptional circumstances clause. Furthermore, beyond a short-term response, it is important that the crisis does not provide an opportunity to exert pressure for greater fiscal discipline. The legitimacy of the Member States in the crisis and the relevance of their responses will be closely scrutinized after the crisis. The EU must not engage in an untimely debate that could lead only to compromising its political legitimacy definitively.

Since there is no tool for pooling debt, the ECB plays a crucial role in maintaining a low level of interest rates for all the States of the Union, both today and tomorrow.

Adapting plans to the way the labour market function

Beyond the sums committed and the institutional level at which decisions are taken, the content of the respective plans is a reminder that the labour markets function very differently on the two sides of the Atlantic. The euro zone Member States have favoured the use of short-time working, or partial unemployment, which keeps workers employed and socializes the loss of income at source. The productive fabric is preserved because there is no breach of the employment contract, and the States offer, based on existing mechanisms, partially to make up lost wages in order to maintain consumer purchasing power. These mechanisms, already in wide use in Germany and Italy, have recently been expanded in France and developed in Spain. This approach should provide better conditions for the economy to re-start once the recession is over, since companies will already have a workforce, thus avoiding the costs of recruitment and training.

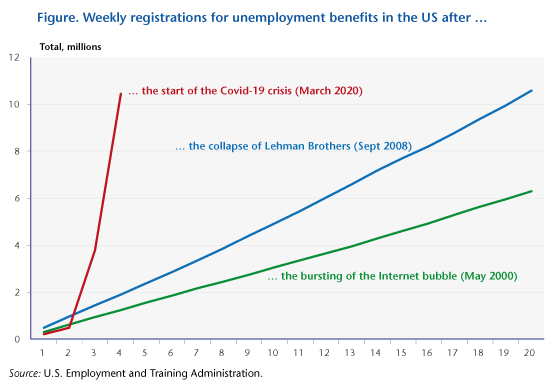

In the United States, these mechanisms are not widespread, and the American labour market is very flexible. Notice times for dismissing employees are very short, so that companies can quickly adjust their demand for work. The drop-off in activity will quickly translate into a higher unemployment rate, as is indicated by the initial increases recorded by the federal employment agency (see the figure). In two weeks, the cumulative number of registered unemployed exceeded 10 million, much more than what was observed after the bankruptcy of Lehman Brothers in September 2008 or following the burst of the Internet bubble in 2000. Furthermore, the duration of unemployment benefits, set at the State level [6], is generally shorter, which quickly puts households at risk of a loss of income. This is why a large part of the measures enacted in the aid plan approved by Congress provide for direct support to households through transfers or tax cuts, based on their income level. The measures also provide for the extension of benefit periods and additional assistance to laid-off workers, which may be added to the benefits received under standard unemployment insurance. But rather than directly targeting those losing their jobs, these are broad spectrum measures. A vigorous recovery plan will no doubt be necessary after the health crisis. But here, too, the windfall effects will consume a large part of the stimulus, and it will be very expensive to get the economy back on its pre-crisis footing.

As the November elections approach, these choices also probably explain why Donald Trump sometimes seems reluctant to prolong the confinement of Americans, arguing that the economic crisis could do more damage than the health crisis [7]. But by letting the virus spread, the number of people infected with a serious illness risks exploding and exposing the United States to a major health crisis. It is not certain that the US President’s record will prove to be more favourable, or the US strategy more effective, whether in terms of health or economics.

[1] This plan builds on previous measures, whose value totalled just over USD 100 billion. This includes all measures for households and businesses (loans and liquidity support).

[2] See https://ec.europa.eu/commission/presscorner/detail/en/IP_20_459

[3] It should also be noted that certain measures were taken based on an assumed duration of confinement, and that these could therefore be recalibrated depending on how the situation evolves.

[4] The vast majority of States, however, have deficit or debt constraints. Faced with the scale of the crisis, some of them are also freeing up spending which can therefore be adjusted to the federal support plan.

[5] If country A decides to increase its spending, country B can hope to partially benefit by the increase induced in country A’s imports from B, particularly if B is small compared to A.

[6] The US unemployment insurance system is specific to each of the States. The federal government plays its role in managing the costs of the system as a whole. See Stéphane Auray and David L. Fuller (2015): “L’assurance chômage aux Etats-Unis”.

[7] See here for an analysis of the economic and health risks.

Leave a Reply