By Fergus Cumming (Bank of England) and Paul Hubert (Sciences Po – OFCE, France)

Does the transmission of monetary policy depend on the state of consumers’ debt? In this post, we show that changes in interest rates have a greater impact when a large share of households face financial constraints, i.e. when households are close to their borrowing limits. We also find that the overall impact of monetary policy depends in part on the dynamics of real estate prices and may not be symmetrical for increases and decreases in interest rates.

From the micro to the macro

In a recent article, we use home loan data from the United Kingdom to build a detailed measure of the proportion of households that are close to their borrowing limits based on the ratio of mortgage levels to incomes. This mortgage data allows us to obtain a clear picture of the various factors that motivated people’s decisions about real estate loans between 2005 and 2017. After eliminating effects due to regulation, bank behaviour, geography and other macroeconomic developments, we estimate the relative share of highly indebted households to build a measure that can be compared over time. To do this, we combine the information gathered for 11 million mortgages into a single time series, thus allowing us to explore the issue of the transmission of monetary policy.

We use the time variation in this debt variable to explore whether and how the effects of monetary policy depend on the share of people who are financially constrained. We focus on the response of consumption in particular. Intuitively, we know that a restrictive monetary policy leads to a decline in consumption in the short to medium term, which is why central banks raise interest rates when the economy is overheating. The point is to understand whether this result changes according to the share of households that are financially constrained.

Monetary policy contingent on credit constraints

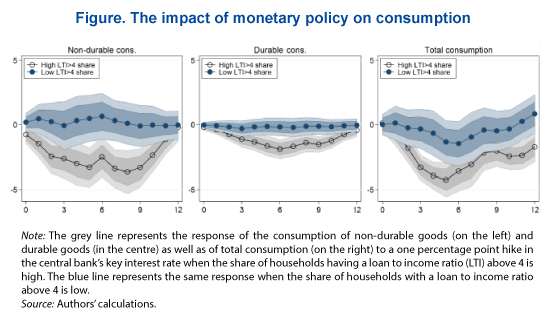

We find that monetary policy is more effective when a large portion of households have taken on high levels of debt. In the graph below, we show how the consumption of non-durable goods, durable goods and total goods responds to raising the key interest rate by one percentage point. The grey bands (or blue, respectively) represent the response of consumption when there is a large (small) proportion of people close to their borrowing limits. The differences between the blue and grey bands suggest that monetary policy has greater strength when the share of heavily indebted households is high.

It is likely that there are at least two mechanisms behind this differentiated effect: first, in an economy where the rates are partly variable[1], when the amount borrowed by households increases relative to their income, the mechanical effect of monetary policy on disposable income is amplified. People with large loans are penalized by the increase in their monthly loan payments in the event of a rate hike, which reduces their purchasing power and thus their consumption! As a result, the greater the share of heavily indebted agents, the greater the aggregate impact on consumption. Second, households close to their borrowing limits are likely to spend a greater proportion of their income (they have a higher marginal propensity to consume). Put another way, the greater the portion of your income you have to spend on paying down your debt, the more your consumption depends on your income. The change in income related to monetary policy will then have a greater impact on your consumption. Interestingly, we find that our results are due more to the distribution of highly indebted households than to an overall increase in borrowing.

Our results also indicate some asymmetry in the transmission of monetary policy. When the share of constrained households is large, interest rate increases have a greater impact (in absolute terms) than interest rate cuts. This is not completely surprising. When your income comes very close to your spending, running out of money is very different from receiving a small additional windfall.

Our results also suggest that changes in real estate prices have significant effects. When house prices rise, homeowners feel richer and are able to refinance their loans more easily in order to free up funds for other spending. This may offset some of the amortization effects of an interest rate rise. On the other hand, when house prices fall, an interest rate hike exacerbates the contractionary impact on the economy, rendering monetary policy very powerful.

Implications for economic policy

We show that the state of consumers’ debt may account for some of the change in the effectiveness of monetary policy during the economic cycle. However, it should be kept in mind that macro-prudential policy makers can influence the distribution of debt in the economy. Our results thus suggest that there is a strong interaction between monetary policy and macro-prudential policy.

[1] Which is the case in the United Kingdom.

Leave a Reply