In the first quarter of 2022, US GDP fell by 0.4%, ending the recovery that had begun in the summer of 2020. The international economic environment had deteriorated significantly due to a combination of negative shocks. The global economic recovery has been accompanied by supply difficulties and a sharp upturn in energy prices, amplified since February 2022 by Russia’s invasion of Ukraine. The conflict has led to heightening geopolitical tensions and fuelled greater uncertainty[1]. Finally, rising inflation has led central banks, particularly the Federal Reserve, to raise interest rates. So is the decline in US GDP at the beginning of the year a sign of a recession, or will it simply put the brakes on growth?

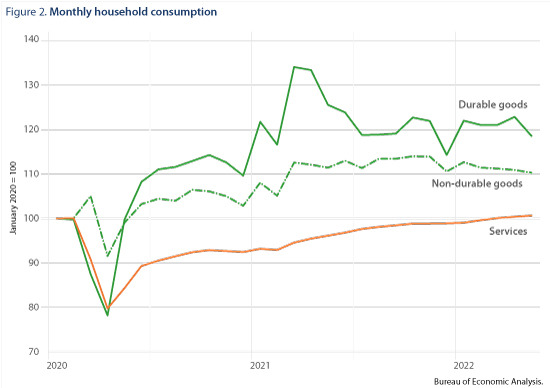

After the steep downturn observed in 2020, the US economy rebounded sharply, and by the second quarter of 2021 GDP exceeded the level of activity seen at the end of 2019. Growth for 2021 as a whole stood at 5.7% and was strongly driven by domestic demand, in particular household consumption, which shot up by 7.9%[2]. The support plans implemented first by the Trump administration and then by Biden more than compensated for the loss of primary household income due to the pandemic, and generally boosted consumption, particularly of durable goods[3]. The dynamism of demand in the US and globally then ran up against supply constraints as new waves of COVID transmission struck. Although the spread of the virus in most countries was not accompanied by the kind of strict prophylactic measures taken in the spring of 2020, the situation nevertheless worsened, clogging up global supply chains and holding back labour supply[4]. This contrast between US demand, supported by highly expansionary fiscal policies, and constrained global supply has pushed prices up. In the US, the consumption deflator excluding energy and food prices rose to 3.3% in 2021, with much higher increases for some goods: 13.2% for cars, for example. Another sign of the imbalance in US growth: the sharp increase in import volumes (+14% over the year compared with a 4.5% increase in exports) has led to a deterioration in the trade balance in goods and services, with a deficit of $1,280 billion in 2021 (or 5.6% of GDP) compared with $905 billion (4.2% of GDP) two years earlier. The contraction of GDP observed in the first quarter of 2022 could be the manifestation of an overheating economy, as domestic demand has remained buoyant: +0.5 points. It is foreign trade’s negative contribution (-1 point) that accounts for the 0.4% fall in GDP.

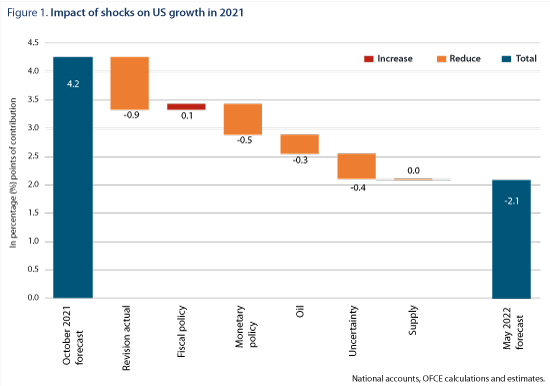

The rest of 2022 will be marked mainly by more negative shocks. While our October forecast anticipated growth of 4.2%, this figure had to be revised downwards significantly (Figure 1) to 2.1%. Although the US is an oil producer, the rise in price nevertheless is having a negative effect due to reduced household purchasing power and higher production costs for business[5]. Assuming that geopolitical tensions remain at the level observed in April until the end of the year, the uncertainty shock will cut growth by 0.4 points[6]. As for supply constraints, these should not have a major recessionary impact in the United States but will undoubtedly contribute to maintaining pressure on prices. The reduction in the growth forecast is also due in part to a stronger-than-expected tightening of monetary policy. Indeed, in the October 2021 scenario, we anticipated that inflation would gradually fall back to the Federal Reserve’s target, implying a much slower normalisation of monetary policy. In the face of the larger and longer-lasting inflationary shock, the Federal Reserve has tightened monetary policy. The last three meetings of the Federal Open Market Committee(FOMC) have resulted in consistent rate hikes, from 0.25% in January to 1.75% in June. This should continue in the second half of the year, with the rate increasing by 1.5 points on average over the year, which would have an effect on growth of up to 0.5 points from 2022. In total, these shocks should therefore cut the forecast for growth by 1.2 points. This effect is being compounded by the fact that actual growth in the third and fourth quarters of 2021 was less strong than we had anticipated: 0.6% and 1.7% respectively, compared with the October 2021 forecast of 1.4% and 2.3%. Finally, these shocks will not be offset by fiscal policy[7].

Given the figure for growth in the first quarter of 2022, quarterly growth during the following three quarters of around 0.3-0.4% should be compatible with annual growth of 2.1%[8]. The economic indicators for the months of April to June confirm a slowdown in US activity in a context of still high inflation. The monthly figures for household consumption, which rose in April (+0.3%) but fell in May (-0.4%), already suggest further slowing. This performance once again continues to be driven by purchases of durable goods, which peaked in March 2021 and have since fallen by 5.6% (Figure 2). Business confidence surveys have confirmed the slowdown, but levels are still above long-term averages. Moreover, industrial output continued to rise in April and May. Finally, on the employment and unemployment front, the figures for June provide a good picture of the second quarter. The unemployment rate stagnated at 3.6%, after having fallen by more than 11 points between April 2020 and March 2022. Employment in turn has risen on average from the first quarter, but the level in June 2022 was lower than in March. These elements therefore point to moderate or even negative growth, particularly if the contribution of foreign trade is again negative. At worst, however, this would be a technical recession[9].

[1] See “L’économie mondiale sous le(s) choc(s)” [The world economy in the face of shock(s)], OFCE Review, No. 177, for a detailed analysis.

[2] Total GFCF increased by 7.7%.

[3] See “Europe / États-Unis, comment les politiques budgétaires ont-elles soutenu les revenus?” [Europe / United States, how have fiscal policies supported incomes?], OFCE the Blog, 26 October 2020.

[4] China was a notable exception because of its “zero Covid” strategy, resulting in local lockdowns.

[5] A recent review of the literature does suggest that higher oil prices reduce household consumption and investment. See A. M. Herrera, M. B. Karaki & S. K. Rangaraju, 2019, “Oil price shocks and US economic activity”, Energy policy, No. 129, pp. 89-99.

[6] See Table 3 on page 32 of “L’économie mondiale sous le(s) choc(s)“, Op. cit.

[7] The estimate of the impact of fiscal policy reflects the revision of the fiscal impulse compared to the scenario envisaged in October 2021. The fiscal impulse was negative due to the end of various one-off measures enacted to address the health crisis. The revision is mainly due to the analysis of the measures included in the 2022 budget by the Biden administration.

[8] The performance in Q1 may well already partly capture the impact of the various shocks.

[9] A technical recession refers to a situation when GDP declines over two consecutive quarters. However, a recession depends on a set of indicators.