As with the economic performance of all the industrialized countries, economic activity fell off sharply in the second quarter of 2020 across the Atlantic before rebounding just as sharply the following quarter. The management of the crisis in the US is largely in the hands of the different States, and the election of Joe Biden should not change this framework since he declared on November 19 that he would not order a national lockdown. However, the health situation is continuing to deteriorate, with more than 200,000 new Covid-19 cases per day on average since the beginning of December. As a result, many States are adopting more restrictive prophylactic measures, although without returning to a lockdown like the one in the Spring. This situation could dampen economic prospects for the end of the year and also for the start of the mandate of the new President elected in November. Above all, it makes it even more necessary to implement a new recovery plan, which was delayed by the election.

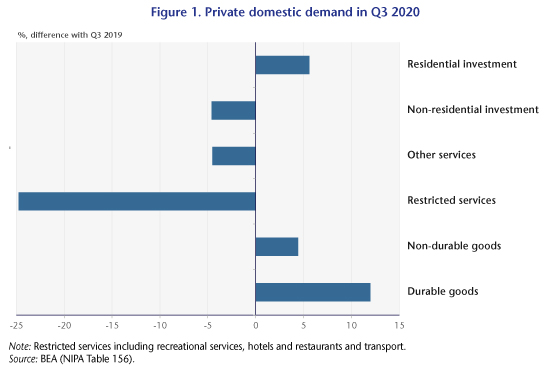

As in the euro zone, recovery in the US kicked off as soon as the lockdown was lifted. GDP grew by 7.4% in the third quarter after falling by 9% in the previous quarter. Compared with the level of activity at the end of 2019, the economic downturn amounted to 3.5 points, versus 4.4 points in the euro zone. The labour market situation also improved rapidly, with the unemployment rate falling by 8 points, according to data from the Bureau of Labor Statistics for November, from its April peak of 14.7%. These results are the logical consequence of the lifting of restrictions but also of the large-scale stimulus plans approved in March and April, which have massively absorbed the loss of income for households and to a lesser extent for US companies (see here). However, the upturn in consumption is still being dampened by some ongoing restrictions, particularly in sectors with strong social interactions, where spending is still nearly 25% lower than it was in the fourth quarter of 2019 (Figure 1). As for the consumption of goods, it has been much less affected by the crisis and is down only 12% from its pre-crisis level for durable goods and 4.4% for non-durable goods. Nevertheless, most of these support measures have come to an end, and as of this writing the discussions that began in late summer in Congress have not yet led to an agreement between Republicans and Democrats. Despite the rebound, the health impact of the pandemic and the economic consequences of the lockdown on the labour market require a discretionary policy in a country where the automatic stabilizers are generally considered to be weaker[1]. New support measures will be all the more necessary as a further tightening of restrictions is looming and the recovery seem to be running out of steam. The initial consumption figures for the month of October point to a fall in the consumption of services, and employment also stabilized in November, remaining well below its level at the end of 2019.

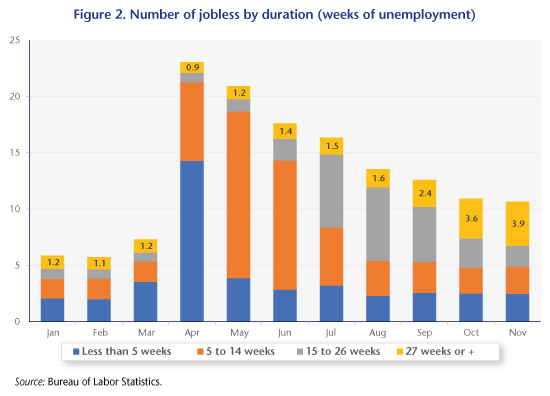

However, after the setback of the discussions in Congress, it will now be necessary to wait until the first quarter of 2021 for a new support plan to be approved and for a possible reorientation of US fiscal policy after Joe Biden’s victory. In the Autumn, the Democrats proposed a 2 trillion dollar (9.5 GDP points) package, almost as much as the 2.4 trillion dollar (10.6 GDP points) package adopted in March-April 2020[2]. The aid would, among other things, support the purchasing power of the unemployed through an additional federal payment. Although unemployment is much lower than in the second quarter, it remains above its pre-crisis level and is now characterized by an increase in long-term unemployment for which there is generally no compensation. In November, the share of those who had been unemployed for at least 27 weeks was 37 per cent (or 3.9 million people, Figure 2), and the median duration of unemployment had risen from 9 weeks at the end of 2019 to almost 19 weeks in November 2020. In addition, States whose tax revenues have decreased with the crisis could benefit from a federal transfer, thereby avoiding spending cuts[3].

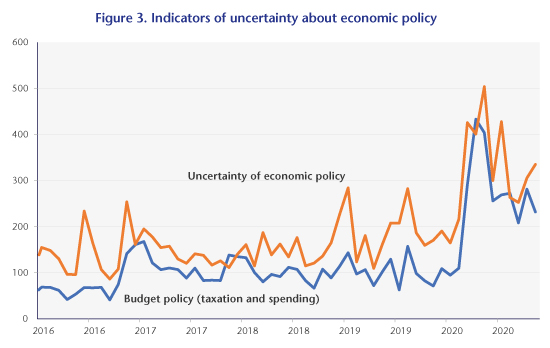

However, despite the end of the suspense over the outcome of the presidential elections, the political and economic uncertainty has not been completely resolved. Indeed, it will not be known until early January whether the Democrats will also have a majority in Congress. They have certainly kept the House of Representatives, but it will be necessary to wait until the beginning of January for the Senate, with a ballot planned in Georgia that will determine the political colour of the last two seats [4]. Both seats are now held by Republican senators. However, Joe Biden won Georgia by 0.2 points against Donald Trump, the first victory in the State for a Democratic candidate since 1992. With both State-wide senatorial elections to be contested directly, the results are likely to be close. If one of the Democratic candidates is defeated, Joe Biden will be forced to contend with the opposition. But, as Paul Krugman points out, the Republicans are generally more inclined, once in opposition, to promote austerity. This is reflected in the uncertainty indicators of Bloom, Baker and Davies, whose economic policy uncertainty rose in November (Figure 3). This uncertainty is certainly lower than in the Spring but remains higher than that observed between 2016 and 2019. During this period, growth could weaken, and then a strong recovery is likely to be followed by more subdued growth, which will have repercussions on the labour market. Regardless of the outcome, a plan will likely be approved in the first quarter of 2021, but its adoption could take longer if it is conditional on an agreement between Republicans and Democrats in Congress. However, this could be lengthy given the urgency of the health and social crisis, and could plunge a significant proportion of the most vulnerable into poverty.

Source : Baker, Bloom & Davis. https://www.policyuncertainty.com/index.html

[1] See for example Dolls, M., Fuest, C. & Peichl, A., 2012, “Automatic stabilizers and economic crisis: US vs. Europe”, Journal of Public Economics, 96(3-4), pp. 279-294.

[2] By comparison, the European programmes are weaker, ranging from 2.6 GDP points for France to 7.2 points for the UK.

[3] Note that the States generally have fiscal rules limiting their capacity to run a deficit.

[4] Of the 100 seats in the Senate, the Republicans already hold 50. In the event of a tie between the two parties, it is the voice of the Vice-President-elect Kamala Harris that will decide between them. A single victory in Georgia would therefore allow the Republicans to retain the majority.

Leave a Reply